Report Overview:

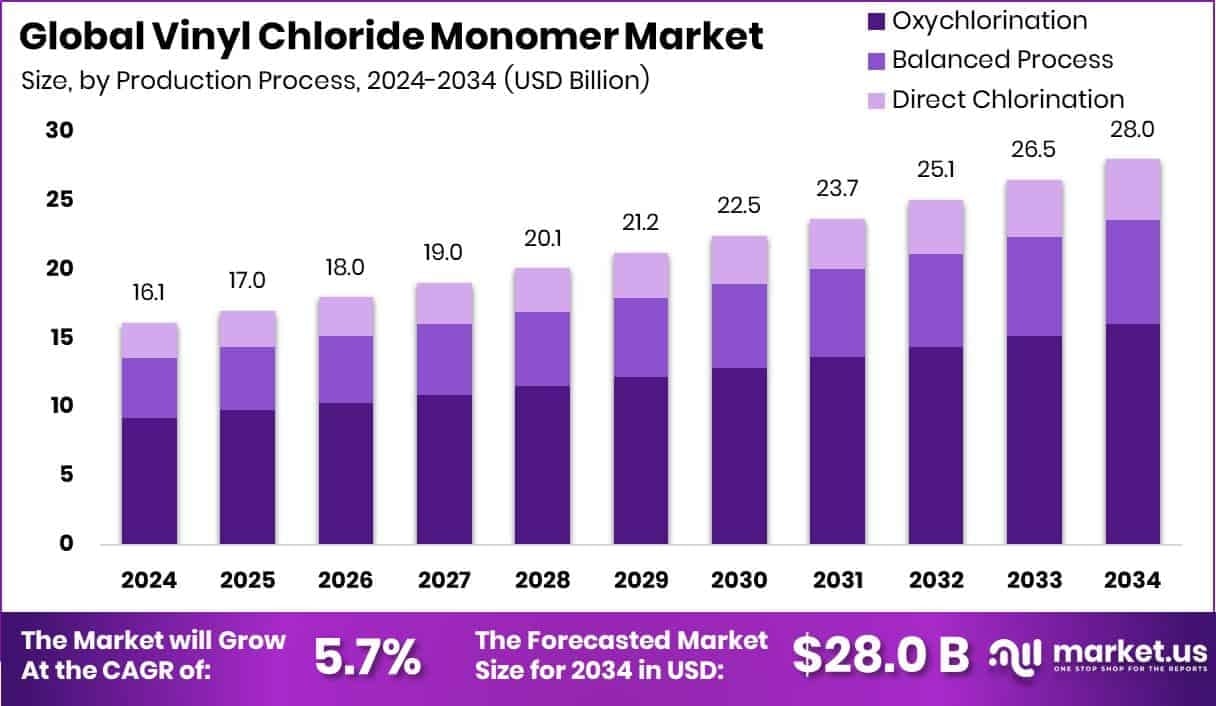

The global Vinyl Chloride Monomer Market was valued at around USD 16.1 billion in 2024 and is projected to reach nearly USD 28 billion by 2034, growing at a CAGR of 5.7% during the forecast period. VCM is a vital industrial chemical mainly used in producing Polyvinyl Chloride (PVC), which is known for being durable, lightweight, and cost effective. These characteristics make PVC highly preferred in construction, healthcare, automotive, and packaging industries.

On a regional level, North America led the market in 2024, with a valuation of around USD 7.7 billion, driven by steady demand from its industrial and building sectors. The oxy-chlorination method dominated the production process, accounting for 57.4% of global output due to its cost-effectiveness and lower energy needs. PVC applications took the largest slice of demand at 79.7%, while construction was the top end-use sector with a 44.8% share.

Global Vinyl Chloride Monomer Market is expected to be worth around USD 28.0 billion by 2034, up from USD 16.1 billion in 2024, and grow at a CAGR of 5.7% from 2025 to 2034. High PVC usage in infrastructure supports North America’s USD 7.7 billion VCM market.

Vinyl Chloride Monomer (VCM) is a colorless, flammable gas used primarily as the key raw material in the production of polyvinyl chloride (PVC). It is synthesized through the chlorination of ethylene and plays a crucial role in a wide range of plastic-based applications. Given its versatility and durability, PVC made from VCM finds usage in construction materials, pipes, electrical cable insulation, medical devices, and packaging.

The Vinyl Chloride Monomer market revolves around the demand and supply of VCM for manufacturing PVC products across various industries. With urbanization and industrial growth on the rise globally, especially in emerging economies, the market for VCM has seen consistent expansion. Demand from the construction and automotive sectors particularly fuels market growth, as both heavily depend on lightweight, durable plastic components derived from PVC.

One of the key growth factors is the rise in infrastructure development projects worldwide. VCM-derived PVC is widely used in plumbing, electrical systems, and structural components due to its corrosion resistance and cost-efficiency. The growing middle-class population and increased housing needs are also contributing to heightened demand.

On the demand side, VCM consumption is heavily influenced by the need for water management systems, wire and cable coatings, and healthcare applications. As developing regions invest more in sanitation and healthcare infrastructure, the demand for durable, low-maintenance plastic materials continues to rise.

Key Takeaways

-

The market is forecast to grow from USD 16.1 billion in 2024 to USD 28 billion by 2034, at a CAGR of 5.7%.

-

Oxy-chlorination leads production, holding a 57.4% share in 2024.

-

PVC dominates usage, with 79.7% of total VCM consumption.

-

Construction is the largest consumer, using 44.8% of VCM globally.

-

North America emerged as a major market, valued at USD 7.7 billion in 2024.

Download Exclusive Sample Of This Premium Report: https://market.us/report/vinyl-chloride-monomer-market/free-sample/

Key Market Segments:

By Production Process

- Oxychlorination

- Balanced Process

- Direct Chlorination

By Application

- PVC

- Copolymer Resins

- Chlorinated Solvents

- Others

By End Use

- Building and Construction

- Healthcare

- Agriculture

- Electrical and electronics

- Automotive

- Others

DORT Analysis

Drivers

Growing PVC demand in construction, infrastructure and plumbing fuels strong VCM use. VCM‑derived PVC is favored for cost‑effectiveness, corrosion resistance and ease of installation. As construction activity rises in urbanizing markets, VCM volumes follow. Demand from automotive, packaging and healthcare sectors adds to momentum.

Opportunities

Investment in bio‑based VCM and greener production methods offers longer‑term growth. Producers focusing on eco‑friendly alternatives can tap into sustainability‑focused buyers. Expansion into emerging regions like Asia‑Pacific, led by India and China, also presents broad prospects, driven by rising infrastructure and industrialization.

Restraints

VCM is classified as a known human carcinogen, and production can emit toxic by‑products, prompting stringent regulatory scrutiny and environmental concerns. These factors may limit capacity expansion or slow approvals. Additionally, raw material price volatility and energy‑intensive production processes squeeze margins.

Trends

A shift toward efficient production technologies like oxy‑chlorination supports supply expansion while reducing costs and emissions. Recycling and reuse strategies for PVC are becoming more important, as are pilot initiatives in European facilities aimed at new PVC recycling technologies. Regional shifts show stronger growth in Asia‑Pacific versus more regulated European markets .

Market Key Players:

- Agc Chemicals

- BASF

- Evonik Industries

- Formosa Plastics Group

- INEOS Group

- Jubail Chevron Phillips

- LG Chem

- Lyondellbasell Industries

- Mitsubishi Chemical Holdings Corporation

- Nissan Chemical Industries, Ltd.

- Nova Chemical

- Occidental Chemical Corporation

- Qatar Vinyl Company

- ShinEtsu Chemical Co., Ltd.

- Wacker Chemie AG

- Westlake Corporation