Report Overview:

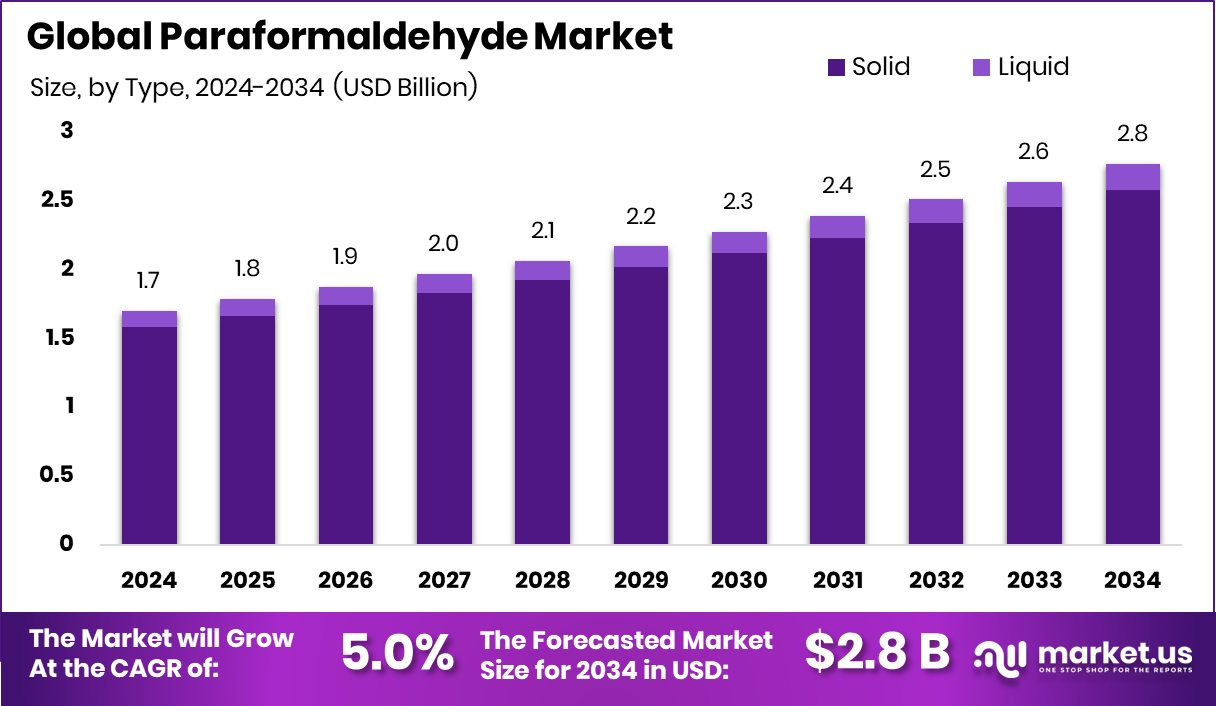

The global paraformaldehyde market is steadily expanding and is expected to grow from USD 1.7 billion in 2024 to USD 2.8 billion by 2034, with a CAGR of 5.0%. The market is mainly led by the solid form, which makes up 93.2% of the total share, thanks to its stability, safety, and easy storage.

Industrial-grade paraformaldehyde also leads among types, holding 88.3% of the market, largely because it’s widely used in various industries. The resin segment stands out as the top application area, accounting for 45.9%, driven by demand from sectors like construction, furniture, and automotive manufacturing. When it comes to regions, Asia-Pacific takes the lead with a 45.3% share (USD 0.7 billion) in 2024, powered by growing usage in countries like China and India, especially in the agrochemical and resin industries.

Paraformaldehyde plays an important role in sectors like agriculture, construction, and healthcare. As countries in Asia and other emerging regions continue to industrialize, the need for products like resins and agrochemicals is rising fast. This has created a strong and steady demand for paraformaldehyde. It’s also becoming more commonly used in pharmaceuticals and sterilization processes, adding to its growing market footprint.

Key Takeaways

-

The paraformaldehyde market is projected to reach USD 2.8 billion by 2034, growing at 5.0% CAGR.

-

Solid paraformaldehyde leads the market with a 93.2% share, due to its better handling and storage benefits.

-

Industrial-grade types dominate at 88.3%, widely used in sectors like agriculture and chemicals.

-

Resin applications hold the top position at 45.9%, supporting construction and furniture industries.

-

Asia-Pacific is the leading region with USD 0.7 billion in revenue, covering 45.3% of the market.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-paraformaldehyde-market/free-sample/

Key Market Segments:

By Type

- Solid

- Liquid

By Grade

- Industrial Grade

- Laboratory Grade

By Applications

- Resins

- Agrochemicals

- Pharmaceuticals

- Additives

- Oil Well Drilling Chemicals

- Others

DORT Analysis

Drivers

Strong demand in agriculture and construction is fueling growth, especially in fast-developing countries. Industrial-grade paraformaldehyde is widely accepted for its cost-efficiency and performance. Applications in resins, disinfectants, and hardeners continue to grow. Rapid urbanization and industrial activity in Asia are further boosting the market.

Opportunities

Producers can tap into eco-friendly production techniques to meet rising environmental standards. Entering partnerships with sectors like healthcare and building materials could lead to new product innovations. Expansion into emerging markets presents strong potential for future profits. There’s also a growing need for customized grades for niche applications.

Restraints

Health and environmental concerns linked to formaldehyde use may result in tighter regulations. Price instability of raw materials could affect production costs and profit margins. Intense market competition might force companies to lower prices. Limited product awareness in smaller markets could hold back adoption.

Trends

There’s a shift toward using more solid forms due to their ease of use and safety. Manufacturers are starting to prioritize sustainable and green technologies. Pharmaceutical and sterilization applications are on the rise. Companies are also working to build resilient supply chains. Cross-industry collaborations are helping to develop unique, high-value products.

By Type Analysis

In 2024, solid type dominated the Paraformaldehyde Market with a 93.2% share.

In 2024, Solid held a dominant market position in the By Type segment of the Paraformaldehyde Market, with a 93.2% share. The solid form of paraformaldehyde is widely preferred due to its high purity levels, ease of storage, and safer handling compared to liquid formaldehyde.

Its ability to depolymerize back to formaldehyde upon heating makes it a highly efficient intermediate in various industrial applications. Industries such as agrochemicals, resins, pharmaceuticals, and coatings rely heavily on solid paraformaldehyde for consistent quality and performance during synthesis and formulation processes.

The dominance of solid paraformaldehyde in the market is further strengthened by its compatibility with large-scale manufacturing systems, especially in pesticide production and resin molding. The low moisture content in the solid variant also ensures longer shelf life and less degradation, which is crucial for export-oriented chemical industries.

With stringent global transportation and safety regulations around liquid formaldehyde, solid paraformaldehyde offers a safer alternative while maintaining effectiveness. Its 93.2% market share highlights its established preference among industrial users who prioritize efficiency, safety, and reliability in chemical operations.

By Grade Analysis

Industrial grade Paraformaldehyde led by 88.3%, driven by widespread industrial processing applications.

In 2024, Industrial Grade held a dominant market position in the By Grade segment of the Paraformaldehyde Market, with an 88.3% share. This grade is widely utilized across key industries such as agrochemicals, resins, and chemical manufacturing, where high volumes and cost efficiency are critical.

The strong demand from pesticide and herbicide producers has particularly driven the consumption of industrial-grade paraformaldehyde, given its effectiveness as a precursor in synthesizing active ingredients. Its suitability for large-scale processing and consistent quality output makes it the preferred choice in high-throughput industrial setups.

Industrial Grade paraformaldehyde is also favored for its role in producing thermosetting resins used in construction and automotive sectors. These resins require a stable and reactive input material, which this grade reliably delivers. Additionally, its ease of handling and storage further support its wide acceptance across production facilities globally.

The 88.3% share reflects the dominance of applications that prioritize volume-driven usage and chemical performance over laboratory-grade precision. As industrial activities expand, especially in developing economies with growing infrastructure and agriculture demand, the use of this grade is expected to maintain its strong foothold.

By Applications Analysis

Resins application held a strong 45.9% share in the global Paraformaldehyde Market usage.

In 2024, Resins held a dominant market position in the By Applications segment of the Paraformaldehyde Market, with a 45.9% share. This significant share is driven by paraformaldehyde’s crucial role in manufacturing thermosetting resins such as phenol-formaldehyde, melamine-formaldehyde, and urea-formaldehyde.

These resins are widely used in construction, automotive, furniture, and electrical industries due to their durability, thermal resistance, and strong bonding properties. Paraformaldehyde acts as a key intermediate that enhances polymer cross-linking, offering superior performance in high-strength adhesives, molded products, and laminates.

The resin segment benefits from large-scale demand for engineered wood products, insulation materials, and industrial coatings—all of which rely on consistent resin quality. With construction and infrastructure activities rising across emerging economies, the use of paraformaldehyde in resin synthesis has seen a corresponding increase. The 45.9% market share reflects its embedded use across value chains where high-volume resin output is essential.

Additionally, the solid form of paraformaldehyde used in resins offers manufacturers better control over reactivity and formulation stability. The dominance of this segment is expected to continue as resin applications expand into new areas such as lightweight composites and heat-resistant coatings.

Market Key Players:

- Celanese Corporation

- Chemanol

- Ercros S.A

- Dover Chemical

- Prefere Resins Holding GmbH

- Alder S.p.A

- Merck KGaA

- Kothari Phytochemicals & Industries Ltd.

- Simalin Chemical Industries Pvt Ltd

- Synthite

- NANTONG JIANGTIAN CHEMICALS CO., LTD

- Jinan xiangrui chemical co., ltd

- Ekta International