Report Overview:

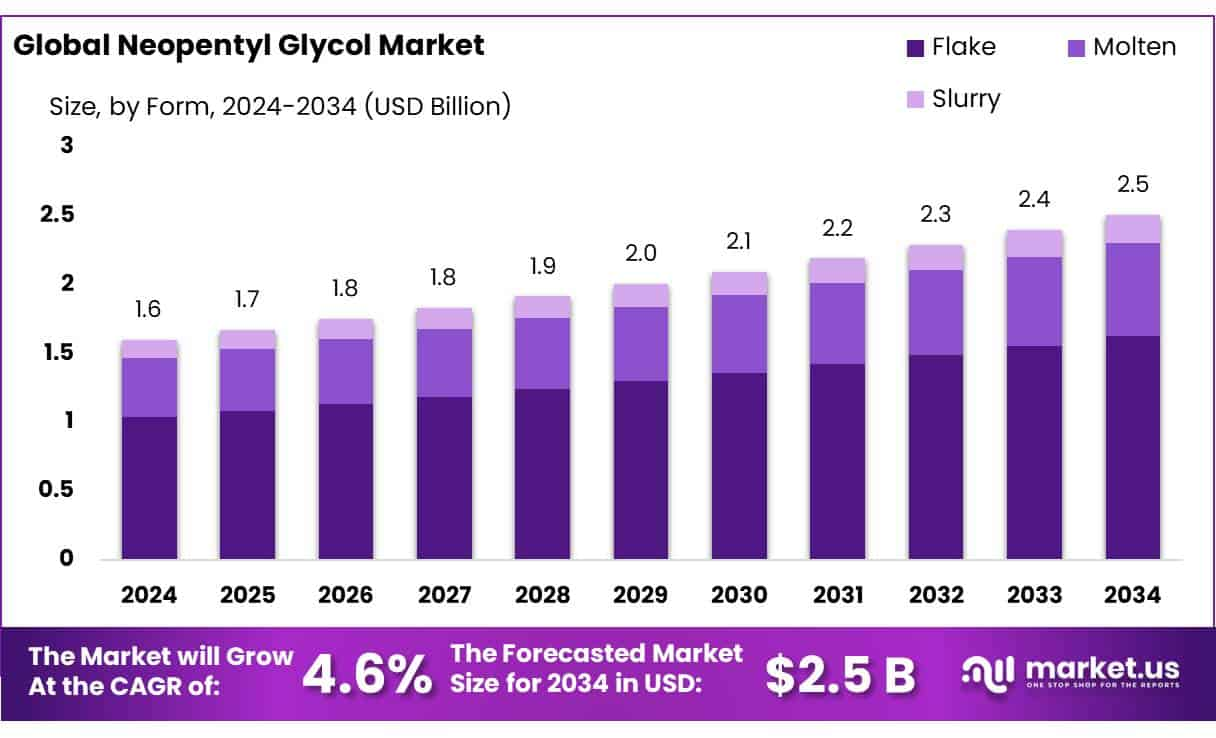

The global neopentyl glycol market is showing steady growth, projected to rise from a value of USD 1.6 billion in 2024 to about USD 2.5 billion by 2034, reflecting a CAGR of 4.6%. NPG is a widely used chemical compound, especially valued for its stability and performance in various industrial applications. It plays a key role in producing resins, plasticizers, coatings, and lubricants.

The flake form of NPG is the most in demand due to its easy handling and processing benefits, accounting for over 64% of the market share. Meanwhile, technical grade NPG dominates the production landscape with an 85.7% share, driven by its suitability for large-scale industrial applications. This growth is primarily supported by rising infrastructure developments and increasing demand for durable, eco-friendly products across construction, automotive, and coating sectors.

Neopentyl Glycol is gaining strong traction across several industries due to its excellent chemical resistance and thermal stability. With the increasing shift toward environmentally safer and long-lasting materials, NPG based products are being preferred over traditional options. Its use in manufacturing high performance coatings and plasticizers is especially notable.

Key Takeaways

-

The global market size is expected to grow from USD 1.6 billion in 2024 to USD 2.5 billion by 2034 at a CAGR of 4.6%.

-

Flake form of NPG holds around 64.8% market share due to ease in handling and manufacturing benefits.

-

Technical grade NPG dominates with over 85.7% share, driven by large-scale industrial usage.

-

Major applications include coatings, adhesives, lubricants, insulation, and plasticizers.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/neopentyl-glycol-market/free-sample/

Key Market Segments:

By Form

- Flake

- Molten

- Slurry

By Grade

- Pharmaceutical Grade

- Technical Grade

By Production Method

- Hydrogenation of HPA

- Disproportionation

By Application

- Paints & Coatings

- Adhesives & Sealants

- Lubricants

- Plasticizers

- Insulation Materials

- Others

By Form

Flake form of Neopentyl Glycol leads the market with 64.8% share in 2024 due to its ease of storage and wide use in resins and coatings.

In 2024, Flake held a dominant market position, capturing more than a 64.8% share in the global Neopentyl Glycol (NPG) market. This form is favored due to its solid-state stability, ease of handling, and efficient storage, which make it suitable for large-scale industrial applications. Flake NPG is commonly used in the production of polyester resins, powder coatings, and lubricants.

The rising demand from the automotive and construction sectors—especially for coatings that offer high durability and chemical resistance—has significantly contributed to the segment’s growth. Industries also prefer flake NPG for its high purity and consistent melting behavior during processing. As infrastructure projects expand globally and demand for weather-resistant materials continues, the use of flake NPG is expected to maintain its lead through 2025.

By Grade

Technical Grade dominates the Neopentyl Glycol market with 85.7% share in 2024, thanks to its high demand in industrial coatings and resins.

In 2024, Technical Grade held a dominant market position, capturing more than an 85.7% share in the global Neopentyl Glycol (NPG) market. This grade is widely used in the manufacturing of alkyd resins, powder coatings, lubricants, and plasticizers due to its high chemical stability and consistent performance. Its suitability for industrial applications like automotive finishes and protective coatings makes it a preferred choice among manufacturers. The steady growth in infrastructure and automotive production, especially across Asia-Pacific and Europe, has further pushed demand for technical-grade NPG. As industrial sectors seek more durable and environmentally compliant coating solutions, this grade is expected to retain its dominance into 2025.

By Production Method

Hydrogenation of HPA leads the market with 78.2% share due to its efficiency and cost-effectiveness in producing Neopentyl Glycol.

In 2024, Hydrogenation of Hydroxy Pivalic Aldehyde (HPA) held a dominant market position, capturing more than a 78.2% share in the global Neopentyl Glycol (NPG) market. This method is favored for its high conversion rates and relatively lower production costs, making it ideal for large-scale industrial manufacturing. The process is also considered more environmentally sustainable compared to other routes, aligning well with growing regulatory emphasis on cleaner chemical production.

The dominance of this method is expected to persist through 2025, particularly driven by demand from end-use industries such as automotive coatings, construction materials, and plasticizers, which rely on bulk, high-purity NPG. The scalability and cost advantage of hydrogenation of HPA make it a preferred method among producers across North America, Europe, and Asia-Pacific.

By Application

Paints & Coatings lead the NPG market with 42.9% share, driven by rising demand for durable and weather-resistant finishes.

In 2024, Paints & Coatings held a dominant market position, capturing more than a 42.9% share of the global Neopentyl Glycol (NPG) market. This dominance is largely attributed to NPG’s strong chemical stability, low volatility, and excellent resistance to heat and weathering, making it a critical ingredient in high-performance coating formulations.

The construction and automotive sectors, especially in emerging economies like India and Southeast Asia, have significantly driven demand for these coatings, as infrastructure development and vehicle production continue to rise. By 2025, the segment is expected to maintain its lead due to the ongoing shift toward environmentally friendly and durable coating technologies, where NPG plays a vital role in achieving low VOC and high-performance outcomes.

DORT Analysis

Drivers

Growing demand from the paints and coatings industry is pushing the need for neopentyl glycol. It’s widely used for its high durability, weather resistance, and performance in protective coatings. Additionally, stricter environmental laws are encouraging industries to adopt low-VOC and high-performance chemicals like NPG. Rising urban development and infrastructure spending, especially in Asia-Pacific, is fueling consumption in end-use industries. Lastly, flake and technical-grade forms make NPG convenient and versatile for mass production in various industrial sectors.

Opportunities

There is major growth potential in the development of advanced powder coatings and waterborne resin technologies. Emerging markets like India, China, and Southeast Asia are offering new spaces for NPG adoption, especially in automotive and construction materials. Eco-conscious innovation, such as bio based NPG production, can also unlock long-term demand. The rise of specialized polymer applications is creating need for high-purity and performance enhanced NPG. Collaborations between NPG producers and coating companies could further drive innovation.

Restraints

Unstable prices of raw materials such as isobutyraldehyde and formaldehyde can directly impact production costs of NPG. Any interruptions in supply chains be it logistics, climate-related disruptions, or energy costs can delay deliveries and affect revenue. Substitution threats from alternative diols like propylene glycol and polyethylene glycol may create pricing pressure. Additionally, trade regulations and compliance hurdles in international markets could act as barriers to expansion for some manufacturers.

Trends

Technical grade NPG remains the most consumed grade in the market due to its compatibility with industrial requirements. Flake form continues to dominate due to better handling and ease in transportation. The steady CAGR of 4.6% indicates long-term market reliability and consistent demand. New innovations in powder and water-based coatings are shaping demand for more stable diol compounds. Supply chain resilience and localized manufacturing are becoming central themes among producers.

Market Key Players:

- Mitsubishi Gas Chemical Company

- OXEA GmbH

- Tokyo Chemical Industry Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Zouping Fenlian Biotech Co., Ltd.

- Shandong Dongchen Ind. Group. Corp.

- BASF SE

- LG Chem Ltd.

- Eastman Chemical Company

- Perstorp Holding AB

- Wanhua Chemical Group

- Mitsubishi Gas Chemical Company

- OXEA GmbH

- Tokyo Chemical Industry Co., Ltd.

- Hefei TNJ Chemical Industry Co., Ltd.

- Zouping Fenlian Biotech Co., Ltd.