Report Overview:

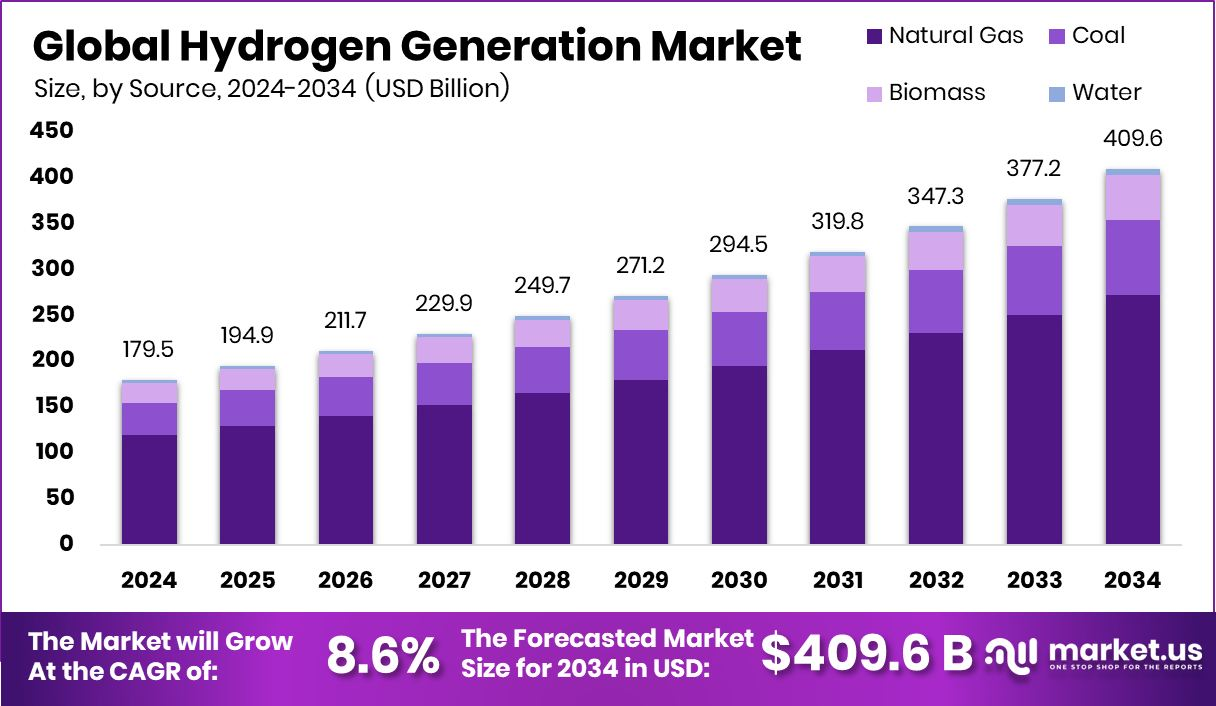

By 2034, the global hydrogen generation market is set to expand significantly, growing from USD 179.5 billion in 2024 to about USD 409.6 billion by 2034, showing a steady 8.6% CAGR over the forecast period. Asia-Pacific is projected to lead the way, representing 41.3% of global market share with a value of USD 74.1 billion in 2024. While traditional methods like steam methane reforming still dominate, a shift toward cleaner and more sustainable hydrogen technologies is gaining momentum.

Key Takeaways

- Natural gas is the main raw material, used in 66.4% of hydrogen production.

- Grey hydrogen, produced without carbon capture, makes up 58.3% of total output.

- Steam Methane Reforming (SMR) accounts for 67.4% of the production method share.

- Around 73.4% of hydrogen is generated on-site for industrial use (captive generation).

- The chemical and petrochemical sectors are the largest consumers, using up 64.6% of the total.

- Asia-Pacific’s strong industrial base keeps it at the forefront of demand and growth.

Sample Report Request For More Trending Reports:

https://market.us/report/hydrogen-generation-market/free-sample/

Key Market Segments

By Source

- Natural Gas

- Coal

- Biomass

- Water

By Type

- Grey Hydrogen

- Blue Hydrogen

- Green Hydrogen

By Technology

- Steam Methane Reforming

- Coal Gasification

- Electrolysis

- Partial Oxidation

- Autothermal Reforming

By Delivery Mode

- Captive

- Merchant

By Application

- Chemical and Refinery

- Petroleum Refinery

- Ammonia Production

- Methanol Production

- Others

- Energy

- Power Generation

- CHP

- Mobility

By Type Analysis

Grey Hydrogen leads by type with a significant 58.3% market share.

In 2024, Grey Hydrogen held a dominant market position in the By Type segment of the Hydrogen Generation Market, with a 58.3% share. This dominance is primarily attributed to its cost-effectiveness and established production infrastructure. Grey hydrogen is typically produced from natural gas using steam methane reforming (SMR) without carbon capture, which remains the most economical and widely adopted method in many industrial sectors.

Industries such as chemicals, petroleum refining, and fertilizers continue to rely heavily on gray hydrogen due to its consistent supply and lower production cost compared to green or blue hydrogen. Its widespread availability, especially in regions where natural gas is abundant, has further solidified its market lead. Despite growing environmental concerns, the economic benefits of grey hydrogen keep it at the forefront of hydrogen generation technologies.

While environmental regulations are becoming stricter, the transition to low-carbon alternatives like blue and green hydrogen is still evolving. Until these cleaner technologies become more financially viable and scalable, grey hydrogen is expected to maintain a major role in the global hydrogen supply chain.

By Technology Analysis

Steam Methane Reforming technology is preferred, with a 67.4% adoption rate.

In 2024, Steam Methane Reforming held a dominant market position in the By Technology segment of the Hydrogen Generation Market, with a 67.4% share. This leadership is mainly driven by its efficiency, scalability, and compatibility with existing infrastructure. As the most widely used method for producing hydrogen, especially from natural gas, SMR continues to be the backbone of industrial hydrogen generation due to its proven reliability and cost-efficiency.

SMR technology plays a crucial role in meeting the high hydrogen demand across sectors such as petrochemicals, refineries, and ammonia production. Its strong link with grey hydrogen production further supports its market hold as industries continue to prioritize low-cost solutions for large-scale operations. The availability of natural gas as a feedstock also strengthens the use of SMR across developed and developing economies.

By Delivery Mode Analysis

Captive delivery mode is prevalent, capturing a 73.4% segment share.

In 2024, Captive held a dominant market position in the By Delivery Mode segment of the Hydrogen Generation Market, with a 73.4% share. This dominance reflects the strong preference among industrial users to produce hydrogen on-site to meet their specific operational needs. Captive hydrogen generation offers several benefits, including reduced dependency on external suppliers, improved supply reliability, and cost savings on transportation and storage.

Industries such as petroleum refining, ammonia production, and methanol manufacturing often rely on continuous and high-volume hydrogen inputs. For these operations, having an on-site generation system ensures process efficiency and avoids the logistical complexity of delivered hydrogen. Additionally, captive systems are designed to match the exact pressure and purity requirements of the user, which enhances overall productivity.

The widespread adoption of steam methane reforming (SMR) technology further complements the captive model, as it enables cost-effective, large-scale hydrogen production using natural gas. The combination of economic advantage and customization has made captive hydrogen generation the preferred choice for large-scale industrial users.

By Application Analysis

Chemical and refinery applications lead, with a 64.6% market usage rate.

In 2024, Chemical and Refinery held a dominant market position in the By Application segment of the Hydrogen Generation Market, with a 64.6% share. This leading position is driven by the critical role hydrogen plays in refining processes and chemical manufacturing, particularly in hydrocracking, desulfurization, and ammonia production. These industries require large volumes of hydrogen to maintain continuous operations and meet stringent product specifications.

Refineries use hydrogen extensively to remove sulfur and other impurities from fuels, especially in response to global regulations for cleaner fuels. Similarly, the chemical industry, especially ammonia and methanol production, depends heavily on hydrogen as a feedstock. These applications demand a stable and uninterrupted hydrogen supply, making them key drivers of the overall hydrogen generation market.

The use of captive hydrogen generation units within these sectors has also contributed to their market dominance, ensuring reliable and cost-effective hydrogen availability. With existing infrastructure already tailored to accommodate large-scale hydrogen usage, the chemical and refinery industries remain the primary consumers in 2024.

Growth Opportunity

- Technological advances in electrolysis are making green hydrogen more viable and cost-effective.

- Global momentum is growing for hydrogen derived from renewable sources, backed by public policy, investment, and climate targets.

Latest Trends

The transition to green hydrogen is picking up speed. Countries like India (via its Green Hydrogen Mission) and EU nations are investing heavily in large-scale electrolyzer deployments. Falling costs in solar and wind energy are further making green hydrogen competitive, encouraging broader adoption across sectors.

Market Key Players

- Linde Plc

- Engie SA

- Air Products and Chemicals, Inc.

- Air Liquide

- INOX Air Products Ltd.

- Messer Group GmbH

- Matheson Tri-Gas, Inc.

- SOL Spa

- Tokyo Gas Chemicals Co., Ltd.

- Iwatani Corporation

- FuelCell Energy, Inc.

- Chevron Corporation

- Cummins Inc.

- BP Plc

- Other Key Players