Report Overview:

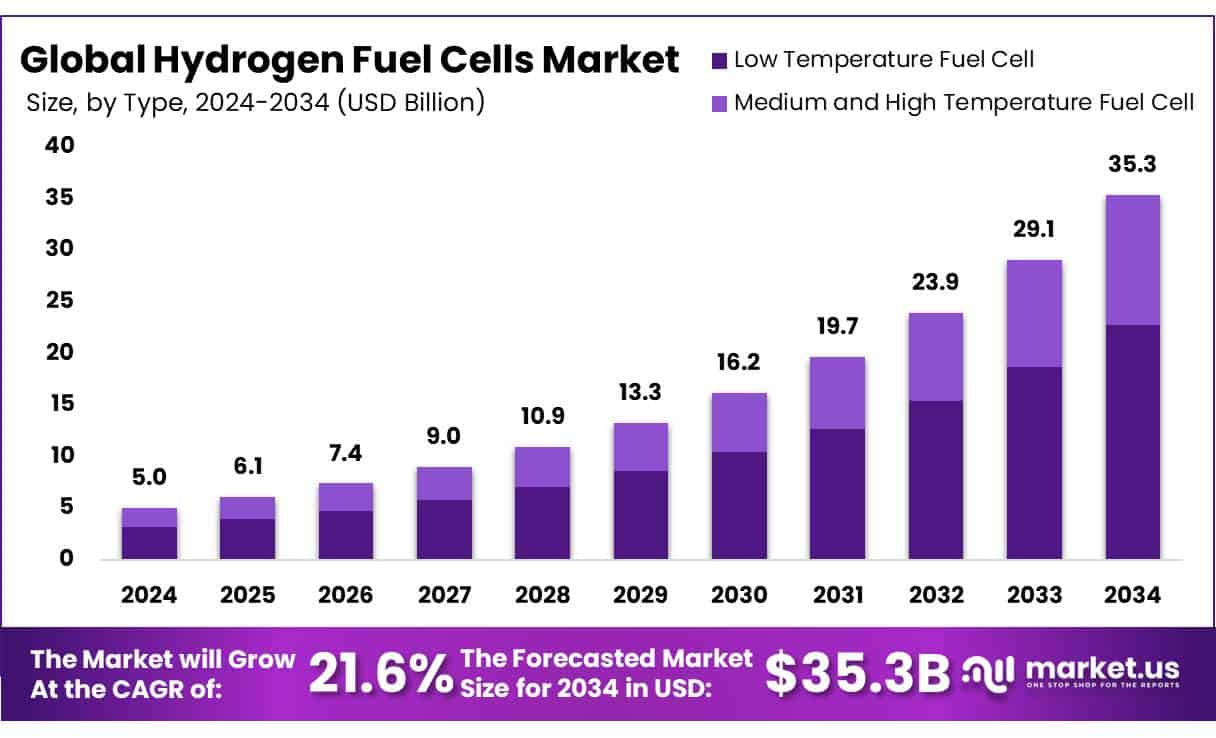

The hydrogen fuel cells market is experiencing rapid growth. Valued at roughly USD 5 billion in 2024, it’s projected to hit USD 35.3 billion by 2034, growing at a compelling CAGR of 21.6%. These fuel cells generate electricity by merging hydrogen and oxygen, emitting only water and heat—making them a clean and efficient energy option that’s gaining recognition worldwide.

Key Takeaways

- Current Market Size (2024): USD 5 Billion → Expected by 2034: USD 35.3 Billion (21.6% CAGR)

- Low-Temperature Fuel Cells dominate with around 67.4% market share.

- PEM Fuel Cells (PEMFC) account for nearly 33.1% within technology types.

- High-Capacity Units (over 200 kW) represent about 33.1% of total demand.

- Stationary applications lead with 53.1% usage, while automotive uses make up 34.1%.

- North America holds the largest regional share at 48.2%.

Sample Report Request For More Trending Reports:

https://market.us/report/global-hydraulic-hoses-market/free-sample/

Key Market Segments

By Type

- Low-Temperature Fuel Cell

- Medium and High Temperature Fuel Cell

By Technology

- Polymer Exchange Membrane Fuel Cell (PEMFC)

- Phosphoric Acid Fuel Cell (PAFC)

- Solid Oxide Fuel Cells (SOFC)

- Direct Methanol Fuel Cells (DMFC)

- Molten Carbonate Fuel Cells (MCFC)

- Alkaline Fuel Cell (AFC)

By Capacity

- Up to 50 KW

- 50 to 100 KW

- 100 to 150 KW

- 150 to 200 KW

- Above 200 KW

By Application

- Portable

- Stationary

- Primary

- Back-up

- Combined Heat & Power (CHP)

- Fuel Cell Vehicles

- Light Duty Vehicles

- Medium Duty Vehicles

- Heavy-Duty Vehicles

By End-Use

- Residential

- Commercial

- Industrial

- Marine

- Automotive

- Military & Defense

- Warehouse Logistics

- Others

DORT Analysis

Drivers

- Strong global policies supporting clean energy alternatives.

- Wide application potential in sectors like transport, emergency power, and grid balancing.

- Government-backed green hydrogen projects in regions like the US, EU, and Australia.

Opportunities

- Growth in hydrogen-powered transport: from cars to cargo ships.

- Wider adoption in warehouse and industrial logistics through hydrogen forklifts and machinery.

Restraints

- High initial investment costs due to advanced components such as platinum.

- Limited refueling infrastructure, especially affecting vehicle adoption.

Threats

- Battery electric vehicles offer strong competition with established support systems.

- Supply chain challenges around rare materials needed for manufacturing.

Growth Opportunity

- Commercial Transport: Ideal for trucks, buses, and ships needing fast refueling and longer ranges.

- Portable Energy Devices: New use cases emerging in defense, off-grid electronics, and emergency services.

- Backup Systems: Growing demand in sectors like telecom and data centers for reliable, clean backup power.

Latest Trends

- Portable Hydrogen Cell Tech: Innovations in lightweight, high-efficiency systems for use in the field.

- Hybrid Electrolyzers & Solid Oxide Fuel Cells: Becoming key in modular and commercial setups due to improved performance and scalability.

Geopolitical Impact Analysis

The global hydrogen fuel cell market is increasingly shaped by geopolitical factors, as countries shift towards securing independent energy and leading in clean technology. With growing concerns over climate change and energy security, major economies like the EU, the U.S., China, and Japan are investing heavily in hydrogen as a strategic alternative to fossil fuels. This shift is influenced by shifting alliances, trade policies, and resource control, especially the access to rare earth metals and clean hydrogen production technologies.

Additionally, global instability such as the Russia-Ukraine war has accelerated Europe’s push toward hydrogen energy to reduce its dependence on Russian gas. At the same time, China’s dominance in green hydrogen infrastructure and electrolyzer production gives it significant strategic leverage in the global energy landscape.

Recently, new tariffs imposed by former President Trump on Chinese goods, including energy-related materials, have created setbacks for both U.S. and Chinese manufacturers. In response, China introduced retaliatory tariffs on energy imports from the U.S., further escalating trade tensions. These geopolitical developments are not only shaping national policies and international partnerships but are also influencing market investments, disrupting supply chains, and affecting the transfer of hydrogen-related technologies. As a result, they play a critical role in determining the pace and direction of hydrogen fuel cell adoption around the world.

Regional Analysis

North America Held the Largest Share of the Global Hydrogen Fuel Cells Market

In 2024, North America dominated the global Hydrogen Fuel Cells market, accounting for 48.2% of the total market share, Driven by increasing demand for clean and sustainable energy solutions, and supportive Government policies, incentives, and a commitment to achieving net-zero emissions goals have further accelerated the adoption of clean energy technologies. Especially countries such as the U.S. and Canada have implemented various federal and state-level programs to encourage the transition towards hydrogen fuel cell vehicles.

- According to the U.S. Department of Energy, there are currently around 17,000 hydrogen-powered vehicles on U.S. roads, all located in California, while electric vehicles (EVs) are in the millions—highlighting hydrogen’s early adoption stage but also its strong growth potential as infrastructure and policy support continue to expand.

Another important factor significantly contributing the North America’s hydrogen fuel cells market growth is the increased demand for hydrogen as a clean fuel source for industries like transportation, heavy manufacturing, and agriculture. As sectors such as shipping, aviation, and freight seek alternatives to fossil fuels, hydrogen fuel cell technology offers a viable way to produce electricity from hydrogen. Additionally, the North American hub of the various global energy industries, along with a region’s robust infrastructure for renewable energy generation and storage, supports the boosting of hydrogen fuel cells. The U.S. has also committed to creating a national hydrogen strategy, with a focus on scaling up hydrogen production and storage capacity. Moreover, Canada’s hydrogen and clean energy initiatives, including investments in carbon capture and storage (CCS), further enhance the growth potential for the hydrogen fuel cell market.

Furthermore, as the demand for green hydrogen and hydrogen fuels continues to rise globally, North America’s technological leadership, policy support, and abundant renewable energy resources position it to maintain its leadership role in the hydrogen fuel cells market. The region is expected to play a critical role in the global transition to a sustainable energy future by helping to decarbonize industrial sectors while continuing to innovate and scale up hydrogen fuel cell technologies to meet growing global demand.

Market Key Players

- FuelCell Energy, Inc.

- Ballard Power Systems.

- Cummins Inc.

- SFC Energy AG

- Bloom Energy

- Doosan Group

- Ceres Power Holdings plc

- Plug Power Inc.

- Toshiba Corporation

- AFC Energy

- Panasonic Holdings Corporation

- PowerCell Sweden AB

- Intelligent Energy Limited

- Pearl hydrogen

- Hyster-Yale Group, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Inocel

- Other Key Players