Report Overview:

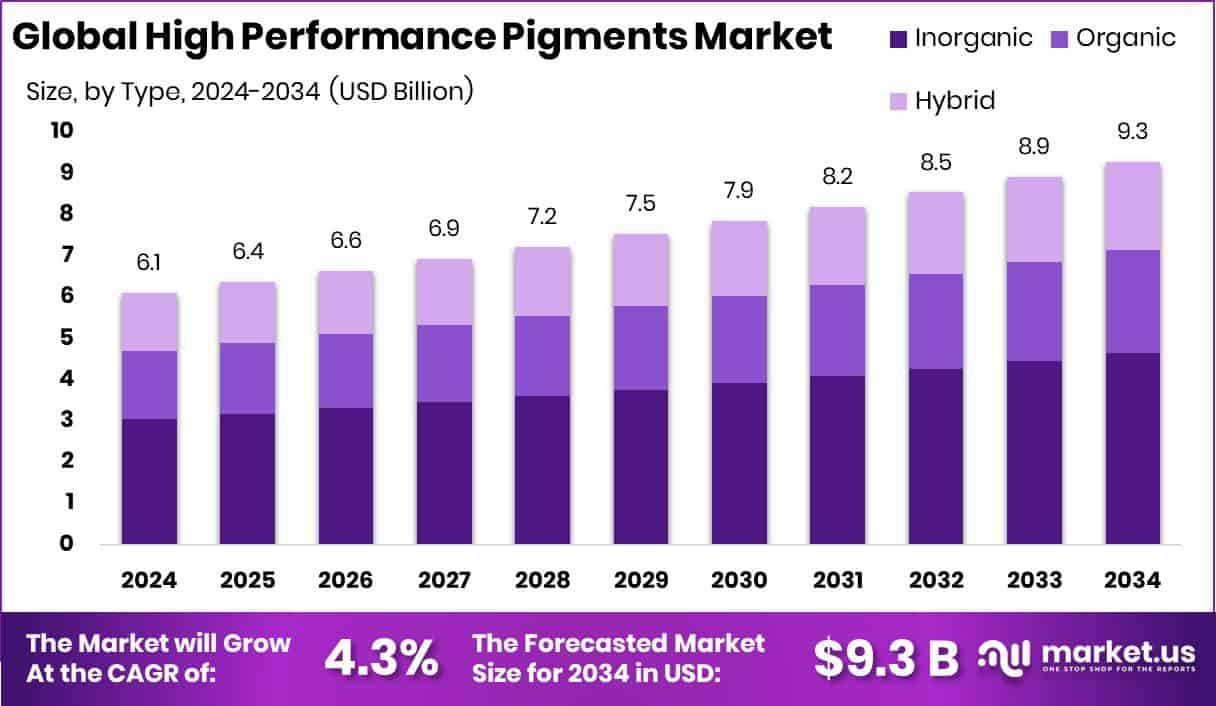

The Global High‑Performance Pigments Market is steadily growing, expected to rise from around USD 6.1 billion in 2024 to about USD 9.3 billion by 2034, showing a healthy CAGR of 4.3%. These pigments are known for their strong heat and light resistance, long-lasting color, and excellent chemical durability, making them ideal for tough applications such as automotive paints, industrial coatings, and construction materials. In 2024, inorganic pigments held the largest share, around 49.9%, due to their superior stability. Meanwhile, powder pigments accounted for nearly 59.1% of the market, thanks to their easy use and longer shelf life. Coatings were the biggest application area, holding 44.2% of the market share. The automotive and transportation segment emerged as the largest end-user category, making up 34.8%, driven by growing demand for durable, high-quality finishes.

Region-wise, Europe dominated the market in 2024, valued at USD 2.3 billion, backed by strict environmental rules and high demand for premium coatings. The market is gaining strength from global shifts like rapid urbanization, infrastructure upgrades, and customized product requirements. As industries aim for durable and low-maintenance solutions, HPPs are a go-to choice. However, one major challenge is their high production cost, mostly due to complex processes and expensive raw materials. This limits wider adoption in cost-sensitive regions. On a positive note, fast-growing economies in Asia-Pacific and Latin America present fresh opportunities, thanks to expanding automotive and industrial sectors. Many companies are also turning their focus to eco-friendly pigment solutions, as environmental awareness and regulatory pressures continue to rise. This green transition is not just a challenge but also an opportunity for innovation and market leadership.

The High-Performance Pigments market has been witnessing steady growth due to the increasing demand for long-lasting and aesthetically appealing colorants in end-use industries. Automotive and construction sectors, in particular, are driving consumption, as manufacturers seek durable finishes that withstand harsh environmental exposure. With rising awareness around material quality and lifespan, industries are turning to HPPs for solutions that go beyond basic coloring needs.

Growth factors include increasing urbanization, infrastructure development, and the rising trend of product customization in consumer goods. As consumers seek high-quality, visually appealing products, the demand for advanced pigmentation solutions continues to grow. The shift towards sustainable and energy-efficient coatings also supports the use of HPPs, which offer better coverage and durability, reducing the need for frequent repainting or replacement.

Opportunities lie in the development of eco-friendly and non-toxic HPPs that meet evolving environmental regulations. There’s also rising interest in specialized applications like electronics, aerospace, and 3D printing, where precision and durability are key. As these industries expand, they create new pathways for innovation and growth in the pigment sector, especially for materials that combine function and aesthetics.

Key Takeaways

-

The HPP market is projected to grow from USD 6.1 Bn (2024) to USD 9.3 Bn (2034) at a CAGR of 4.3%.

-

Inorganic pigments led the market with nearly 50% share, known for their durability.

-

Powder pigments were preferred, making up around 59.1% due to ease of use.

-

Coatings remained the top application segment with 44.2% share.

-

The automotive and transportation sector accounted for 34.8%, driven by durable finish demand.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-high-performance-pigments-market/free-sample/

Key Market Segments:

By Type

- Inorganic

- Organic

- Hybrid

By Form

- Powder

- Liquid

- Granules

By Application

- Coatings

- Plastics

- Inks

- Cosmetics

- Others

By End-use

- Automotive and Transportation

- Construction and Infrastructure

- Printing

- Others

DORT Analysis

Drivers

-

Increasing need for high-quality coatings in automotive and industrial sectors boosts pigment demand.

-

Rising urban infrastructure projects in developing regions create strong demand for advanced coatings.

-

Industries are focusing more on durable, long-lasting finishes, driving HPP adoption.

-

Growing awareness about maintenance cost savings is making HPPs more attractive to manufacturers.

Opportunities

-

Rapid industrial growth in Asia-Pacific and Latin America opens new markets for HPPs.

-

Demand is growing for environmentally friendly pigments due to regulatory pressures.

-

Advanced R&D in nanotechnology and smart pigments is unlocking premium product segments.

-

New applications in electronics, aerospace, and cosmetics present strong expansion paths.

Restraints

-

High production costs and use of costly raw materials raise the end price.

-

Price fluctuations in raw materials add uncertainty to profitability.

-

HPPs are still considered expensive alternatives to traditional pigments.

-

Strict regulations on chemicals can delay or increase production complexity.

Trends

-

Inorganic pigments remain dominant due to unmatched durability.

-

The powder form of pigments is widely adopted for its long shelf life and ease of use.

-

Demand is concentrated in coatings, especially in transport and construction.

-

The market is leaning toward eco-safe, low-VOC pigments in response to green initiatives.

Market Key Players:

- ALTANA

- BASF SE

- Atul Ltd.

- CINIC

- Clariant

- DIC Corporation

- Ferro Corporation

- GHARDA CHEMICALS

- Heubach GmbH

- LANSCO COLORS

- Lanxess

- Meghmani Organics Ltd.

- Sudarshan Chemical Industries Limited

- Sun Chemical

- Synthesia A.S.

- Venator Materials PLC

- Vijay Chemical Industries

- VOXCO India