Report Overview:

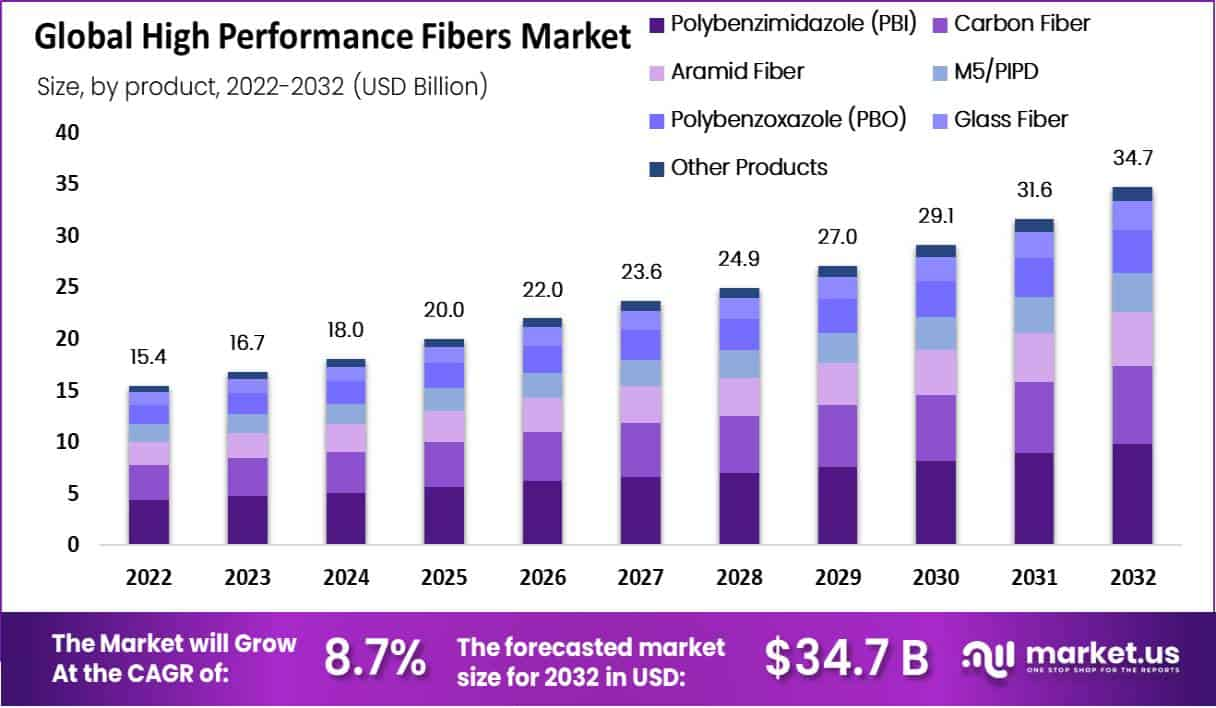

In 2022, the global high-performance fiber market was valued at USD 15.4 billion, with projections indicating it could rise to USD 34.7 billion by 2032, at a solid CAGR of 8.7%. These advanced fibers are essential in industries like aerospace, defense, electronics, and sporting goods, as they offer exceptional heat resistance, high strength-to-weight ratios, and durability. With growing substitution of conventional materials like metals and plastics, their importance continues to grow across industrial applications.

High-performance fibers are specialized materials designed to withstand extreme conditions—such as high temperatures, stress, chemical exposure, or mechanical wear—without losing their strength, durability, or integrity.ommon types include carbon fiber, aramid fiber, polybenzoxazole (PBO), and polyimide fibers, which are known for their exceptional tensile strength, light weight, and resistance to heat and corrosion.

Key Takeaways

- Current Market Size (2022): USD 15.4 billion

- Estimated Market Size (2032): USD 34.7 billion

- CAGR: 8.7% (2023–2032)

- Top-Selling Product: Polybenzimidazole (PBI)

- Leading Application Area: Aerospace & Defense (44% revenue share)

- Main End-Use Segment: Personal Use

- Regional Leader: Asia-Pacific (43.4% revenue share)

Sample Report Request For More Trending Reports:

https://market.us/report/high-performance-fiber-market/free-sample/

Key Market Segments

Based on Product

- Carbon Fiber

- Polybenzimidazole (PBI)

- Aramid Fiber

- M5/PIPD

- Polybenzoxazole (PBO)

- Glass Fiber

- High Strength Polyethylene

- Other Products

Based on Application

- Electronics & Telecommunication

- Textile

- Aerospace & Defense

- Construction & Building

- Automotive

- Sporting Goods

- Other Applications

Based on End-User

- Personal

- Public

- Other End-User

DORT Analysis

Drivers

- Rising demand for strong, lightweight materials

- Innovation in fiber production technologies

- Expansion in EV and aerospace sectors

Opportunities

- Tailored fiber development and custom solutions

- Increasing consumption in developing economies

- Enhanced use in protective gear and high-stress environments

Restraints

- Elevated manufacturing costs

- Raw material pricing volatility

- Presence of lower-cost alternatives

Threats

- Difficulty in scaling up production

- Competitive pressure from advanced substitutes

Growth Opportunity

- Integration of 3D printing and nanotech is lowering fiber production costs.

- Demand in electric vehicles is rising as these fibers reduce weight and boost performance.

- Rapid urban development in countries like India and China is supporting industrial fiber use.

Latest Trends

- Advancements in carbon fiber tech enhance its appeal across more applications.

- Greater reliance on fiber composites for fuel-efficient aircraft.

- Expanding use of eco-conscious and smart textiles.

- Launch of innovative products like Twaron Black for high heat resistance.

Driving Factors

Development of new manufacturing technologies:

With the development of new advanced technologies such as 3D printing and nanotechnology, it is now possible to manufacture high-performance fibers that have improved properties at lower costs. In the future, this is expected to raise the demand for high-performance fibers.

Increasing demand for electric vehicles:

Electric vehicles are expected to increase in popularity, which will lead to a rise in demand for high-performance fibers. These fibers reduce weight and improve the fuel efficiency of electric vehicles by using them.

Growing demand from emerging economies:

The demand from developing nations has grown. Countries like China and India are rapidly industrializing and urbanizing. This has enhanced the need for high-performance fibers. These nations make significant infrastructure investments, which fuels the market for high-performance fibers. The market for high-performance fibers is anticipated to expand in the upcoming years as a result of technical improvements, rising sustainability awareness, and growing demand from emerging economies.

Restraining Factors

The availability of substitute materials:

In some circumstances, substitute materials may provide high-performance fibers with equivalent performance qualities at a less expensive price. For instance, carbon fibers are frequently replaced by steel and aluminum in automobile applications.

Although high-performance fibers are stronger and lighter than conventional materials, for certain producers the cost reductions of alternative materials may be more attractive.

High cost of production:

High-performance fiber manufacture is a difficult, expensive process that requires specialized tools and expertise. High-performance fibers are made from expensive raw materials including aramid, carbon fiber, and glass fiber.

These elements raise the cost of manufacture relative to conventional fibers, which might prevent some businesses from adopting them. The failure of manufacturers to scale up results due to the high cost of production may hinder market expansion.

By Product Analysis

The Polybenzimidazole (PBI) Segment Accounted for the Largest Revenue Share in High-Performance Fibers Market in 2022

Polybenzimidazole fibers (PBI) are expected to have the highest CAGR, at more than 14.00%, due to the superior properties of the product. These include a high glass transition, no melting temperature, and an extremely high temperature for heat deflection.

PBI fibers find applications in a variety of products, including safety and heat garments such as firefighter’s uniforms and gloves.

PBI fibers can be used in a variety of applications, including high-performance fibers such as Kevlar. PBI fibers are flexible and have low moisture gain, low tenacity, and a superior strength-to-weight ratio.

They also do not burn or melt. These fibers are used for plastic reinforcements and heat and chemical-resistant filters. They can also be found in civil engineering applications.

The Carbon Fibers Segment is the Fastest Growing Type Segment in the High Performance Fibers Market.

Due to its numerous uses in the aerospace sector, including rockets, aircraft, missiles, and satellites, carbon fiber was the second-largest product.

Additionally, the demand is anticipated to be fueled by the rising use of CFRCs in aircraft components because of their lightweight and stiffness characteristics. The weight of carbon fiber structures is around one-third that of aluminum and half of steel.

By Application Analysis

The Aerospace and Defense Segment Accounted for the Largest Revenue Share in High-Performance Fibers Market in 2022

In 2022, the aerospace and defense application sector dominated the market and accounted for over 44% of the global revenue share.

Since the sector is going towards lightweight materials in an effort to increase the cost-efficiency and environmental performance of the aircraft, it is anticipated to achieve a consistent CAGR from 2022 to 2030.

infoTo learn more about this report – request a sample report PDF

infoTo learn more about this report – request a sample report PDFTherefore, the production of aircraft depends on lightweight, high-strength, and fiber-reinforced composite materials. Lightweight materials and structures have a great advantage in aircraft applications because they provide strength and stiffness with reduced weight.

This reduces fuel consumption significantly. These materials allow aircraft, especially military aircraft, to carry more fuel and payload, extending their missions and reducing downtime.

By End-User Analysis

The Personal Segment Accounted for the Largest Revenue Share in High Performance Fibers Market in 2022

Based on end-user, the market is segmented into Personal, Public, and Other End-User. Among these types, the personal segment is expected to be the most lucrative in the global high performance fiber market, with the largest revenue share during the forecast period.

High-performance fibers used in personal protection equipment are often referred to as the personal segment of the high-performance fibers market.

Market Key Players

- Toray Industries, Inc.

- Dupont

- Teijin Limited

- Toyobo Co. Ltd

- DSM

- Kermel S.A.

- Kolon Industries, Inc.

- Huvis Corp.

- I. du Pont de Nemours and Company

- Zoltek Companies Inc.

- Kamenny Vek

- Koninklijke Ten Cate NV

- Other Key Players