Report Overview:

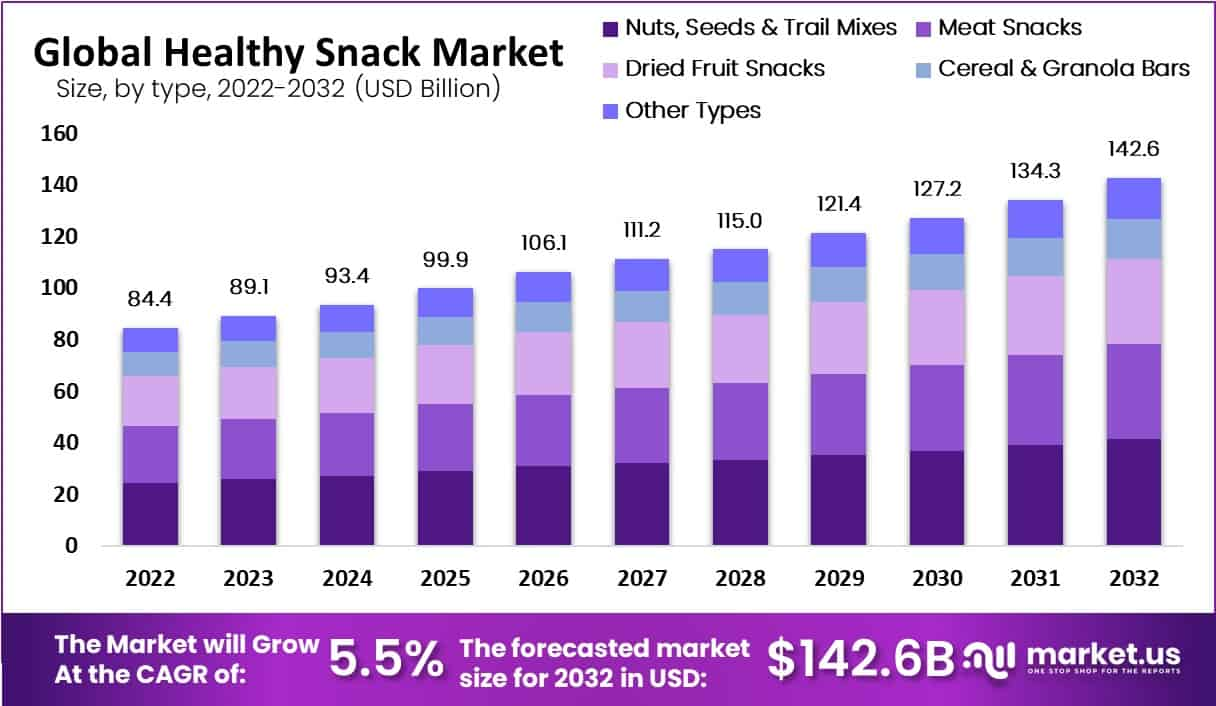

The global healthy snack market is witnessing consistent growth, expanding from around USD 89.1 billion in 2023 to an anticipated USD 142.6 billion by 2032, progressing at a 5.5% CAGR. This rise highlights a shift in consumer preferences toward snacks that are both nutritious and convenient to consume.

Key Takeaways

- Steady growth: The market is projected to grow from USD 89.1 billion in 2023 to USD 142.6 billion by 2032, with a consistent 5.5% CAGR.

- Leading categories: “Nuts, seeds & trail mixes” topped the list in 2023 with USD 24.5 billion and are projected to reach USD 41.4 billion by 2032. Other popular items include meat snacks, dried fruits, and granola bars.

- Sales channels: Hypermarkets and supermarkets account for the largest market share (31–44%), followed by convenience stores (27%), specialty shops (18%), and online retailers (14%).

- Shifting preferences: Consumers are prioritizing ease and health—91% placed convenience as a top factor in 2021, and 72% now prefer snacks that come in portion-controlled packs (up from 63%).

Sample Report Request For More Trending Reports:

https://market.us/report/healthy-snack-market/free-sample/

Key Market Segments

Based on Type

- Frozen & Refrigerated

- Fruit, Nuts and Seeds

- Bakery

- Savory

- Bars and Confectionery

- Dairy

- Others

By Packaging

- Bag & Pouches

- Boxes

- Cans

- Jars

- Others

Based on Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Other Distribution Channels

Type Analysis

Fruit, Nuts and Seeds Hold a Major Market Share Attributed to their High-protein Content & Easy Consumption

In 2023, Fruit, Nuts and Seeds held a dominant market position, capturing more than a 38.2% share of the healthy snacks market. This segment benefits from the consumer’s preference for natural and minimally processed foods. Fruits and nuts are not only convenient but also packed with essential nutrients, making them a top choice for health-conscious buyers.

The Frozen & Refrigerated segment also plays a crucial role in the market. These products offer convenience while maintaining the nutritional integrity of snacks. Innovations in freezing and refrigeration technology have improved the quality and appeal of these snacks, making them a practical option for busy consumers seeking healthful choices.

Bakery products, encompassing items like whole-grain breads, muffins, and other baked goods, are increasingly being sought after for their comfort food aspect while still aligning with health standards. Manufacturers are incorporating healthier ingredients and reducing harmful fats and sugars to cater to health-focused individuals.

Savory snacks, which include items like vegetable chips, whole-grain crackers, and air-popped popcorn, provide a tasty alternative to traditional high-calorie, high-salt snacks. The demand in this category is driven by consumers desiring flavorful yet healthy options.

Bars and Confectionery have witnessed substantial growth due to their portability and convenience. Protein bars, granola bars, and low-sugar confections are particularly popular among people who lead active lifestyles or need quick meal replacements.

The Dairy segment includes yogurt, cheese snacks, and other dairy-based products known for their protein and calcium content. With an increase in the availability of low-fat and fortified dairy options, this segment is appealing to both health enthusiasts and general consumers looking for nutritious snack options.

By Packaging

In 2023, Bags and Pouches held a dominant market position, capturing more than a 41.8% share of the healthy snacks packaging market. This popularity stems from their convenience, lightweight nature, and the ability to preserve freshness. Bags and pouches are favored for their portability and ease of use, making them ideal for on-the-go consumption.

Boxes are another significant packaging type in the healthy snacks market. They are primarily used for cereals, bars, and baked goods, providing sturdy protection and easy stacking for storage. Boxes also offer excellent opportunities for branding, with ample space for attractive designs and nutritional information, appealing to health-conscious consumers.

Cans are used less frequently but remain relevant for packaging nuts, seeds, and some fruit snacks. They are valued for their long shelf life and ability to protect contents from air and light, preserving the nutritional quality of the snacks inside.

Jars, typically glass or high-quality plastic, are used for premium or artisanal snack products. They are popular in the packaging of high-value nuts, gourmet spreads, and organic or specialty items. Jars are reusable and recyclable, aligning with the environmental consciousness of many health snack consumers.

Distribution Channel Analysis

In 2023, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 44.2% share of the healthy snacks market distribution channels. These large retail spaces are favored for their wide range of products and the convenience of one-stop shopping, allowing consumers to access a diverse selection of healthy snacks alongside their regular grocery purchases.

Convenience Stores also play a crucial role in the distribution of healthy snacks. Due to their widespread presence and extended operating hours, they offer easy access to quick snack options for consumers on the move. This channel is particularly popular among busy professionals and commuters who seek nutritious snacks without deviating from their daily routes.

Specialty Stores, which focus on health foods and dietary specific products, cater to a niche market. These stores attract health-conscious consumers looking for organic, gluten-free, or vegan snack options that may not be available in mainstream retail outlets.

Online Retail has seen significant growth in the distribution of healthy snacks. The convenience of home delivery and the ability to easily compare prices and product reviews have propelled the popularity of this channel. Consumers appreciate the breadth of options available online, from exotic superfoods to locally-sourced organic snacks.

Other Distribution Channels include vending machines in schools, offices, and hospitals, as well as direct sales from producers at farmers’ markets and through subscription snack boxes. These channels offer unique points of access to healthy snacks, catering to specific consumer needs and environments.

Growth Opportunity

- Clean-label innovation: Consumers increasingly favor transparent ingredient lists and smaller, healthier portions.

- Digital evolution: Direct-to-consumer models and e-commerce growth are reshaping the snack-buying experience.

- Developing regions: With increasing income levels, emerging markets are poised for strong healthy snack adoption.

- Functional focus: Snacks that offer added health benefits—like high-protein or gut-friendly formulas—are in high demand.

Latest Trends

- Controlled portions: A growing number of consumers (72%) now choose portioned snacks for health and convenience.

- On-the-go packaging: Demand is increasing for grab-and-go options like bars and resealable packs.

- Natural ingredients: Preference is shifting toward snacks with minimal processing and clean labels.

- Hybrid shopping habits: Pandemic-influenced buying behavior favors a blend of physical and online shopping—74% expect flexible options.

Market Key Players

- PepsiCo Inc.

- Nestle S.A.

- Unilever PLC

- Tyson Foods Inc.

- Kellogg Company

- B & G Foods Inc.

- Mondelēz International

- Harvest Almond Snacks

- Happytizers Pvt Ltd

- Other Key Players