Report Overview:

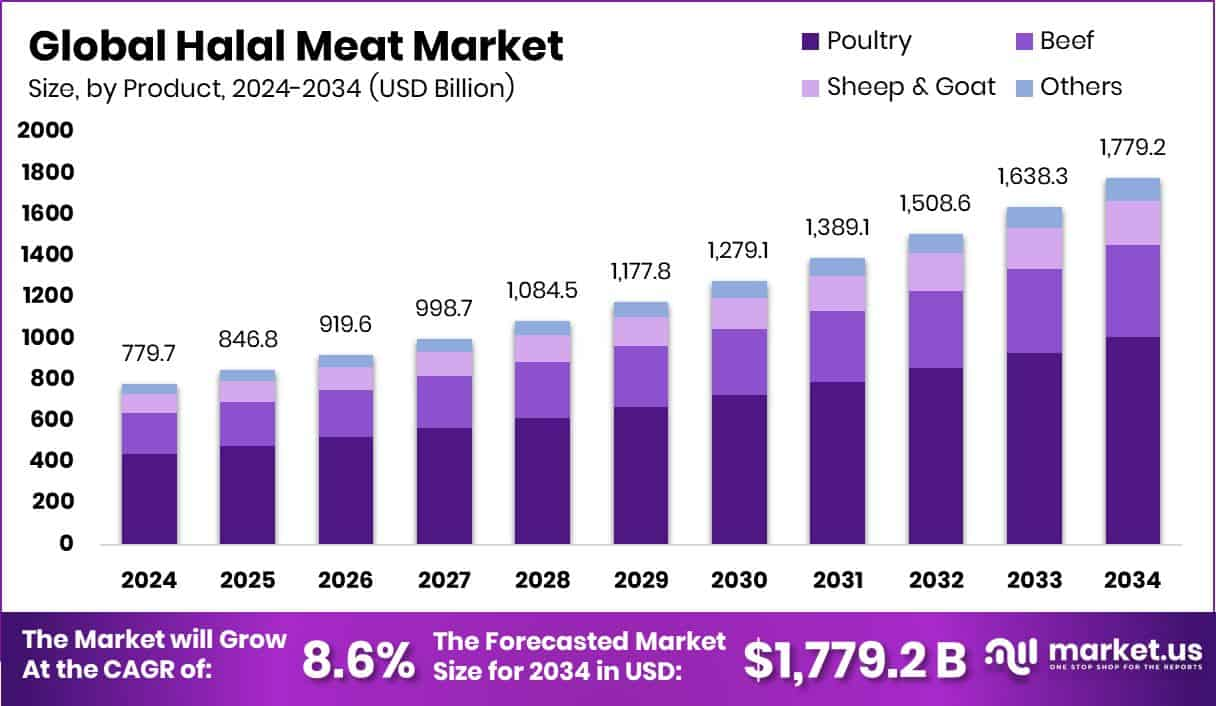

The global halal meat market is set to grow significantly, moving from USD 779.7 billion in 2024 to an estimated USD 1,779.2 billion by 2034, registering a strong 8.6% CAGR from 2025. This market includes meats such as poultry, beef, and lamb, all prepared under Islamic dietary laws. These products are offered fresh or as processed and ready-to-eat varieties, and they’re distributed through wholesalers, supermarkets, convenience stores, and online platforms. Market expansion is mainly fueled by the growing Muslim population and increasing consumer interest in clean, ethically sourced foods.

Key Takeaways

- Market Size Growth: From USD 779.7 billion (2024) to USD 1,779.2 billion (2034), with 8.6% CAGR.

- Leading Meat Type: Poultry accounts for 56.7% of market share.

- Dominant Product Form: Fresh meat holds 62.3% of the market.

- Top Distribution Channel: B2B/wholesalers make up 44.8% of sales.

- Primary End-user: Food service providers consume 58.3% of halal meat.

- Strongest Regional Market: Asia-Pacific leads with 41.2% share, worth USD 321.2 billion.

Sample Report Request For More Trending Reports:

https://market.us/report/halal-meat-market/free-sample/

Key Market Segments

By Product

- Poultry

- Beef

- Sheep and Goat

- Others

By Type

- Fresh

- Processed

- Sausages

- Cold Cuts

- Ready-to-eat Meat Meals

- Others

By Distribution Channel

- B2B/Wholesaler

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

By End-user

- Food Service

- Household

By Product Analysis

Poultry leads the Halal Meat Market with a 56.7% share.

In 2024, Poultry held a dominant market position in the By Product segment of the Halal Meat Market, with a 56.7% share. This substantial market presence can be attributed to the widespread consumption patterns and cultural acceptance of poultry within diverse communities observing halal dietary guidelines. As a primary source of affordable protein, poultry surpasses other meat types in accessibility and versatility, making it a staple in both household and commercial food preparations.

The market’s favorability towards poultry is also reinforced by its relative ease of production and lower environmental footprint compared to red meats, which aligns with the growing consumer emphasis on sustainable and ethical food choices. Additionally, advancements in halal certification processes have streamlined the supply chains, ensuring that poultry products meet the stringent halal standards demanded by consumers globally.

This has further solidified poultry’s position as a key player in the halal meat industry, driving growth and expanding its market reach through innovative product offerings and enhanced distribution strategies. These factors collectively underscore the segment’s robust performance and pivotal role in shaping the dynamics of the Halal Meat Market.

By Type Analysis

Fresh halal meat comprises 62.3% of the market type.

In 2024, Fresh held a dominant market position in the By Type segment of the Halal Meat Market, with a 62.3% share. This prominence is largely driven by consumer preferences for freshly processed meats, which are perceived as healthier and more flavorful compared to their frozen counterparts. The preference for fresh halal meat is particularly strong in regions with large Muslim populations, where there is a significant emphasis on the quality and freshness of meat, due to Islamic dietary laws.

The robust demand for fresh meat is supported by the development of rapid logistics and cold storage solutions that maintain the integrity of meat from slaughter through to retail. Furthermore, the increasing number of halal-certified slaughterhouses and improved regulatory frameworks across various countries have also contributed to the accessibility and trust in the fresh meat segment.

Retailers and butchers specializing in halal products have capitalized on this trend by emphasizing the superior quality and taste of fresh meat, conducting live butchery demonstrations, and engaging directly with consumers about the benefits of fresh halal meat. These marketing strategies have reinforced consumer trust and loyalty, driving the segment’s growth and solidifying its market dominance.

By Distribution Channel Analysis

B2B/Wholesalers distribute 44.8% of halal meat.

In 2024, B2B/Wholesaler held a dominant market position in the By Distribution Channel segment of the Halal Meat Market, with a 44.8% share. This leading position underscores the critical role of wholesalers in the distribution chain, serving as essential intermediaries between meat processors and retail outlets. Wholesalers are pivotal in managing large volumes of halal meat, ensuring that they reach various market segments efficiently, from small independent retailers to supermarkets and restaurants.

The strength of B2B/Wholesaler channels in the halal meat market is attributed to their ability to provide extensive logistics and storage solutions, which are vital for maintaining the integrity and halal status of the meats during transport and storage. Moreover, these wholesalers often have well-established relationships with halal certifiers to guarantee compliance with religious dietary laws, thereby instilling confidence among downstream retail partners and ultimately, the end consumers.

Additionally, the reliance on wholesalers is heightened by the expanding global demand for halal meat products, necessitating robust supply chains that can handle the complexities of international trade and regulatory compliance across borders.

By End-user Analysis

Food Service consumes 58.3% of the market.

In 2024, Food Service held a dominant market position in the By End-user segment of the Halal Meat Market, with a 58.3% share. This segment’s prominence reflects the extensive use of halal meat within the restaurant and catering industries, which cater to a growing global Muslim population keen on dining experiences that adhere to Islamic dietary laws.

The food service sector’s demand for halal meat is driven by the expansion of halal-certified dining establishments in both predominantly Muslim and non-Muslim countries, showcasing the broadening appeal and acceptance of halal food. These establishments not only serve to meet religious requirements but also attract a diverse clientele looking for ethical and quality food options.

Moreover, the segment benefits from the rising trend of gourmet and specialty dining that focuses on the provenance and ethical sourcing of ingredients, including halal-certified meats. Food service providers are increasingly promoting transparency in their halal meat sources, enhancing consumer trust and satisfaction.

Growth Opportunity

Fresh halal meat is appealing to more consumers, thanks to faster delivery systems and better refrigeration. Processed meat products offer convenience to on-the-go customers. Businesses can tap into these opportunities by improving supply chains, ensuring halal compliance, and focusing on e-commerce, especially in fast-growing regions.

Latest Trends

Consumers, especially younger Muslims, are driving demand for certified, hygienic halal meat. More halal-certified facilities are helping strengthen trust. At the same time, online platforms are making it easier to access a wide variety of halal meat options, satisfying the growing demand for convenience, transparency, and quality.

Market Key Players

- BRF Global

- Thomas International

- Tyson Foods, Inc.

- Hormel Foods Corp

- Nema Halal

- Crescent Foods

- Harris Ranch Beef Co.

- Midamar Corporation

- Danish Crown

- Vion

- Bigard

- Al Kabeer Group ME

- Amana Foods

- Al Islami Foods

- Tariq Halal

- Tahira Foods Ltd

- Saffron Road

- American Foods Group, LLC

- Tallgrass Beef

- Ena Meat Packing

- Al-Aqsa

- SIS Company

- Prairie Halal Foods

- DOUX

- Other Key Players