Report Overview:

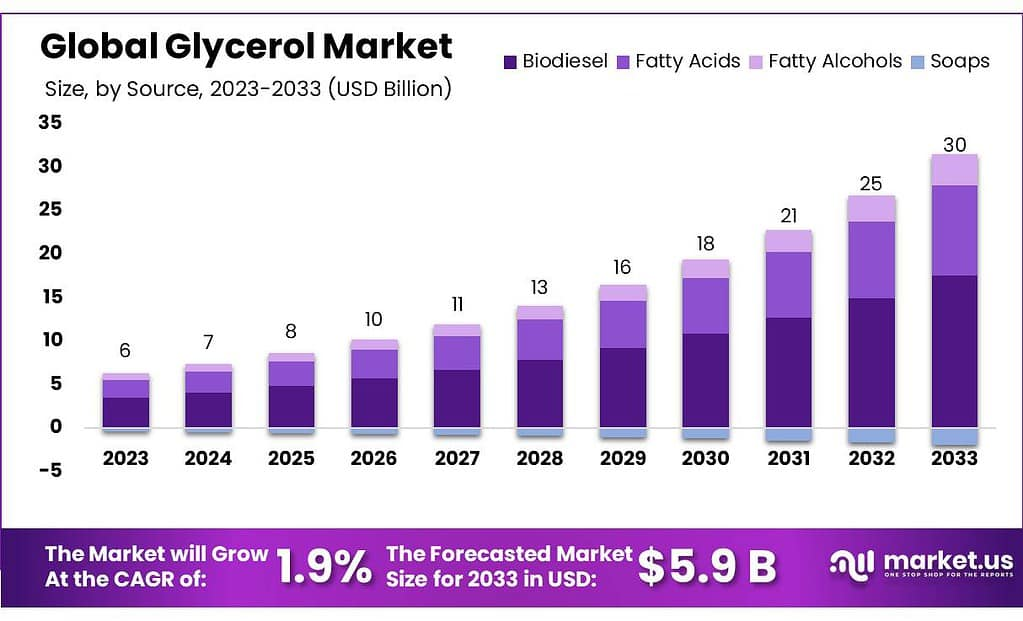

The global Glycerol Market was valued at USD 4.9 billion in 2023 and is anticipated to reach USD 5.9 billion by 2033, registering a CAGR of 1.9% over the forecast period. This moderate but consistent growth is largely fueled by increasing utilization of glycerol in various industries, including pharmaceuticals, personal care, and food & beverages. Its multifaceted role as a humectant, sweetening agent, and solvent has made it indispensable across numerous consumer and industrial products.

Asia Pacific held the dominant share in 2023, thanks to a surge in consumer health awareness and demand for wellness-oriented products. Refined glycerol led the market with a 78% share, while biodiesel emerged as the primary source, accounting for nearly 59.5% of total production.

Key Takeaways

-

Market Value: Expected to rise from USD 4.9 Bn (2023) to USD 5.9 Bn (2033) at a CAGR of 1.9%.

-

Refined Glycerol: Represented 78% of the total market in 2023, driven by use in cosmetics and home care.

-

Crude Glycerol: Poised for rapid growth at 6.2% CAGR, with increasing application in personal care and supplements.

-

Biodiesel-based glycerol accounted for 59.5%, benefiting from green energy initiatives.

-

Pharmaceuticals and nutraceuticals are expanding swiftly.

-

Fatty alcohols are gaining popularity in cosmetics and cleaning products.

- Personal care & cosmetics dominated with 34% share in 2023

- Asia-Pacific led regional demand, advancing at 6.5% CAGR due to lifestyle and dietary shifts.

Sample Report Request For More Trending Reports:

https://market.us/report/glycerol-market/free-sample/

Key Market Segments

By Type

- Refined

- Crude

By Source

- Biodiesel

- Fatty Acids

- Fatty Alcohols

- Soaps

By End-use

- Food & Beverage

- Nutraceutical

- Pharmaceutical

- Industrial

- Personal Care & Cosmetics

- Other End-uses

Type Analysis

Glycerol’s most profitable segment, the refined segment, earned 78.0% of total revenue for 2023.

Refined Glycerin can be described as a colorless, odorless liquid with a high boiling point. It is a useful addition to many personal and home-care formulas due to its moisturizing and emulsifying qualities. These attributes will contribute to the increased demand for this product in the future.

In the next five decades, the crude segment will witness a 6.2% compound annual growth rate. Because of its impurities and lack of fatty acids, crude glycerol will be less popular. Due to the growing demand for crude glycerol, which is used in personal care products and nutraceuticals.

Source Analysis

In 2023, Biodiesel held a dominant market position, capturing more than a 59.5% share. This was primarily due to the growing demand for renewable energy sources and the expansion of biodiesel production worldwide.

This segment is expected to grow at 6.5% annually in the next few years. It is used as a byproduct in the production of biodiesel fuels using chemical & enzymatic processes & the production of bioethanol. Because of its low price and biodegradable, renewable & non-toxic characteristics, biodiesel is a preferred source of glycerol.

The segment of fatty alcohols is expected to see the greatest CAGR over the estimated period. It is widely used in the manufacture of detergents and surfactants. They are also used in industrial solvents, as well as constituents in the food, beverage, and cosmetic industries. Glycerol market growth is expected to be accelerated by the increasing demand for fatty alcohol from these industries over the estimated period.

End-Use Analysis

In 2023, personal care and cosmetics held a dominant market position, capturing more than a 34% share. This was due to the widespread use of glycerol in skincare, haircare, and cosmetic products, leveraging its moisturizing and emollient properties.

This can be attributed to a rise in personal care & pharmaceutical products due to a better lifestyle and growing health awareness in emerging economies in Latin America and the Asia Pacific.

Glycerol can be used to improve smoothness, lubrication, or as a humectant. Glycerol is used in products such as hair products, skincare, shaving cream, and personal lubricants that are water-based. In the estimated period, the pharmaceutical segment will see the highest CAGR. Because of its healing and nutritional properties, the product is often used in pharmaceuticals. It is also found in toothpaste, expectorants, and mouthwashes. Glycerol is expected to see a significant increase in demand in the future for its various uses in pharmaceutical applications.

The product can also be used in food preservatives, as well as the making of explosives and perfumes. It helps other ingredients dissolve faster when it is added to water or alcohol in perfumes. Glycerol can be converted to nitroglycerin through a reaction with sulfuric acid. It can also be used in anti-freeze and lubrication as well as printing inks.

Growth Opportunity

The pharmaceutical and nutraceutical industries offer promising avenues for glycerol, where it functions as a key component in liquid medicines, dietary supplements, and health-centric food products. Its adoption in sugar-free and diabetic-friendly foods is particularly encouraging.

The Asia-Pacific region represents a hotspot for growth, supported by rising consumer awareness and expanding urban demographics. Additionally, the increased application of cost-effective crude glycerol in emerging markets supports its broader market penetration.

Latest Trends

One of the leading trends is the rising use of glycerol from biodiesel production, aligning with environmental sustainability and clean fuel initiatives. This is helping to lower production costs while opening up new applications.

Consumer interest in natural, eco-friendly ingredients is also reshaping the market. Glycerol’s plant-based and biodegradable nature makes it attractive in formulations for skincare, cosmetics, and wellness products. Its dual applicability in food and pharmaceutical sectors is helping companies create streamlined, multifunctional product lines.

Market Key Players

- BASF SE

- Cargill, Incorporated

- Procter & Gamble

- Oleon NV

- KLK OLEO

- Dow

- ADM

- Wilmar International Ltd.

- Kao Corporation

- Emery Oleochemicals

- COCOCHEM

- Godrej Industries Limited

- Monarch Chemicals Ltd

- Aemetis, Inc.

- CREMER OLEO GmbH & Co. KG

- Sakamoto Yakuhin Kogyo Co.Ltd.

- Fine Chemicals & Scientific Co.