Report Overview:

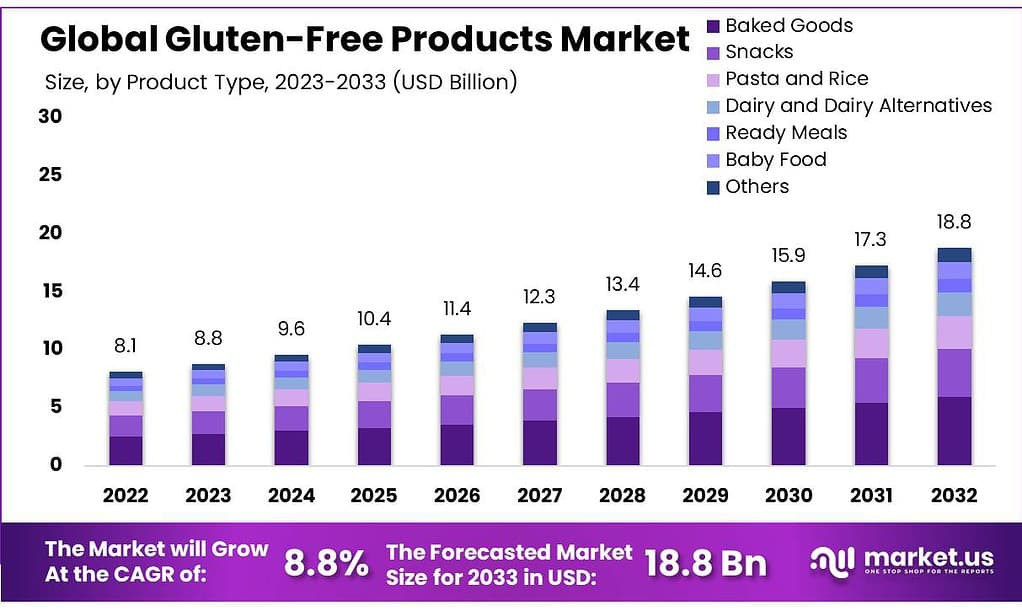

The global Gluten-Free Products Market stood at USD 8.1 billion in 2023 and is anticipated to climb to USD 18.8 billion by 2033, growing at a CAGR of 8.8% throughout the forecast period. This steady growth is largely influenced by growing health awareness, increasing diagnoses of celiac disease, and a post-pandemic shift toward more health-conscious dietary habits.

Gluten-free products are developed without gluten, a protein typically found in wheat, barley, and rye. These items cater not only to those with gluten intolerance or celiac disease but also appeal to a broader base of health-conscious consumers opting for cleaner dietary choices.

The global Gluten-Free Products market size is expected to be worth around USD 18.8 billion by 2033, from USD 8.1 billion in 2023, growing at a CAGR of 8.8% during the forecast period from 2023 to 2033.

Gluten-free products will be in demand due to the rising incidence of celiac and other conditions resulting from unhealthy lifestyles. This market is expected to grow because of the increased consumption of healthy food products to prevent diseases such as diabetes, heart disease, obesity, chronic lung disease, metabolic syndrome, and other health conditions.

Due to the rising health and wellness concerns of consumers, the use of gluten-free products has been impacted by the COVID-19 pandemic.

Key Takeaways

The market is forecasted to more than double in value by 2033.

Bakery products dominated the market in 2023, holding over 31.5% of the global share.

The bakery segment is anticipated to grow at a CAGR of 11.7% through 2032 due to innovation and increased demand.

Supermarkets and hypermarkets represented 27.3% of distribution sales in 2023.

Online distribution channels are expected to grow rapidly, with a projected CAGR of 12.8%, supported by the rise in e-commerce.

North America accounted for the largest regional share in 2023 at 37.2%.

Asia-Pacific is the fastest-growing region, with an estimated CAGR of 13% through the forecast period.

Sample Report Request For More Trending Reports:

https://market.us/report/gluten-free-products-market/free-sample/

Market Key Segments:

By Product

Bakery Products

Desserts & Ice Creams

Prepared Foods

Pasta and Rice

Other Products

By Distribution Channel

Convenience Stores

Specialty Stores

Online

Supermarkets & Hypermarkets

Other Distribution Channels

Growth Opportunity

Emerging regions, particularly Asia-Pacific, offer promising growth potential due to increasing urbanization and consumer awareness about dietary wellness. Technological advancements like micro-encapsulation are enhancing shelf life and product quality, broadening market reach. There’s also growing demand for gluten-free items enriched with nutritional benefits, attracting a wider audience beyond those with dietary restrictions.

Latest Trends

Current market trends reveal a move toward convenient and clean-label food options. The popularity of ready-to-eat gluten-free snacks is rising, especially among health-conscious younger consumers. Retailers are increasing their private-label offerings to meet this demand. Online sales continue to surge due to digital shopping trends, while plant-based ingredients are being used more frequently in gluten-free formulations, aligning with broader health and sustainability movements.

Product Analysis

In 2023, Baked Goods stood out in the gluten-free products market, securing a dominant share of more than 31.5%. These gluten-free baked items, including bread, cookies, and cakes without gluten, were in high demand among consumers seeking alternatives due to gluten intolerance or dietary preferences.

The segment growth is expected to be driven by rising awareness about healthy eating, including organic, natural, and gluten-free. The future growth of the segment will be influenced by factors such as the existence of a broad product portfolio and continuous innovation.

The primary driver of the bakery product segment is the growing demand for gluten-free bread. Packaged bread manufacturers, including the U.K.’s major player Warburton’s, have developed free-from sub-brands for their flagship brands. These are becoming increasingly popular among consumers from all income levels.

A number of bakery startups are now offering gluten-free bread, like Coconut Wraps by NUCO in America. This is a product that is not only gluten-free but also meets all other health criteria such as raw, organic, vegan, and paleo. From 2032 to 2032, the bakery segment will experience the fastest CAGR at 11.7%.

It is expected that the availability of many products at reasonable prices, along with the convenience of ready-to-eat foods, will have a positive effect on the segment’s growth. Additionally, growing awareness about the health benefits of baking products and rapid urbanization will likely drive growth.

Distribution Channel Analysis

In 2023, Supermarkets and Hypermarkets asserted their dominance in the gluten-free products market, securing a significant share of more than 27.3%. These expansive retail giants played a pivotal role in catering to the demands of consumers seeking gluten-free alternatives.

They offered a diverse array of gluten-free products market across various categories, providing convenience and a one-stop shopping experience for individuals looking for these specialized items.

Seasonally driven displays include gluten-free products. This promotes new products and expands the market. It is easier to deal with one large customer base than with many smaller customers. Because supermarkets and hypermarkets can access a large customer base, they have huge sales volumes. A national distribution network allows for greater brand recognition, which in turn leads to higher sales volumes.

The supplier also benefits from a contract with large supermarkets while they seek financial support for product development. These food manufacturers prefer to sell their products through hypermarkets and supermarkets. This leads to greater penetration.

From 2023 to 2032, the online segment will experience a 12.8% CAGR. The benefits of the online channel include shopping at home, delivery to your doorstep, free shipping, and discounts. This channel is attracting the millennial generation and younger generations. Online channels were also crucial for retailers during the COVID-19 pandemic.

Newer delivery methods are also making a difference in the retail sector. Customers and retailers alike prefer click-and-collect (also known as BOPIS or buying online and picking it up in-store) over curbside pickup. Pickup may be more convenient than home delivery because it allows customers to pick up their items at any time they want, instead of waiting for delivery. These innovations in services will make online shopping more attractive over the forecast period.

Market Key Players

Conagra Brands, Inc.

Nestlé SA

The Hershey Company

DR. SCHÄR AG/SPA

ENJOY LIFE NATURAL

General Mills, Inc.

Kellogg Company

The Kraft Heinz Company

Genius Foods

Amys Kitchen Inc.

Bobs Red Mill Natural Foods Inc.

Campbell Soup Co.

The Hain Celestial Group, Inc.

Conclusion:

Gluten-free products are no longer a niche market—they’ve gone mainstream. With growing demand, technological innovation, and increasing consumer focus on health and convenience, the market is set for robust expansion. Brands that prioritize taste, nutrition, and accessibility will be best positioned to lead in this evolving industry landscape.