Report Overview:

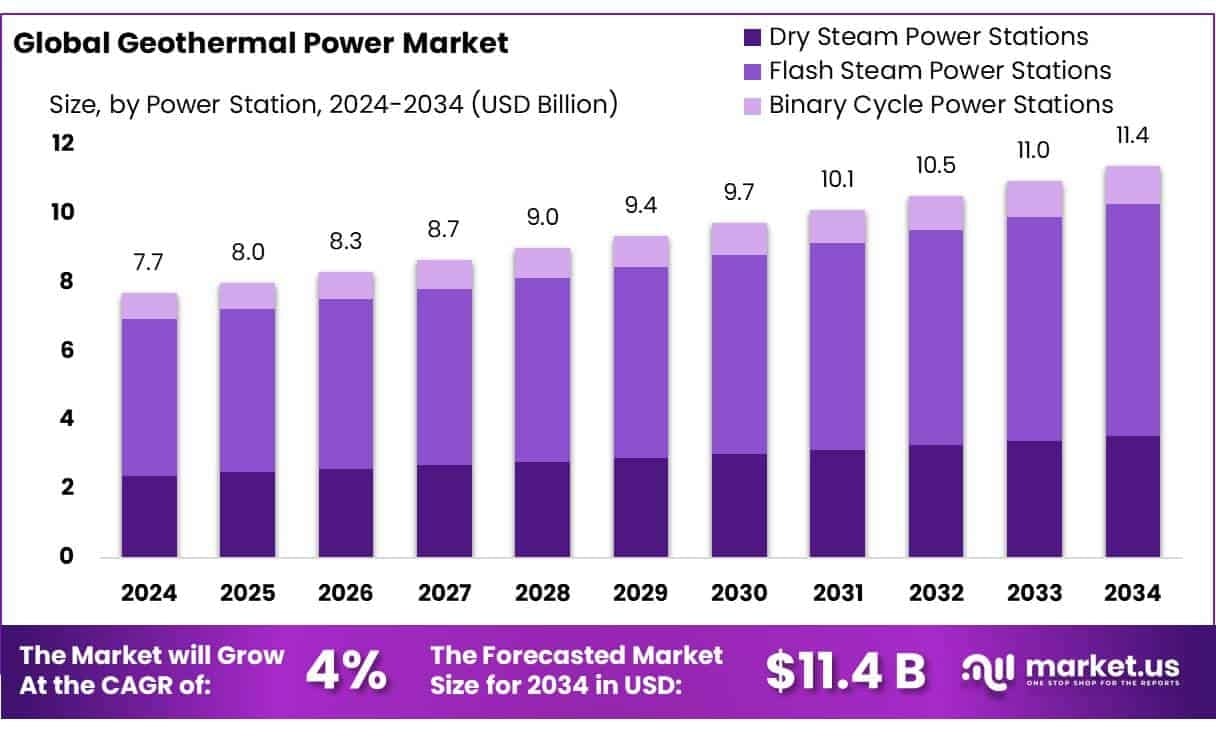

The global geothermal power market is projected to grow from about USD 7.7 billion in 2024 to USD 11.4 billion by 2034, at a steady 4.0% CAGR during 2025–2034. The most widely deployed technology is Flash Steam Power Stations, accounting for over 59.4% of the market, thanks to its efficiency with high-temperature resources found in countries like the U.S., Indonesia, and the Philippines. Plants generating up to 5 MW are especially common, representing around 87.6% of global capacity.

High-temperature resources (above 150 °C) dominate, making up more than 74.5% of capacity, since they support reliable and efficient energy output. The industrial sector is also the leading end-use, capturing around 65.9% of market share, largely due to stable power needs and heat applications. Geographically, North America leads with close to 48.6%, equivalent to USD 3.7 billion, driven by strong policy backing, technology infrastructure, and vast geothermal reserves

Key Takeaways

- Market projected to grow ~48% over a decade (2024–2034) at a 4.0% CAGR.

- Flash steam tech, small plants, and high-temperature reservoirs drive market dominance.

- Industrial users take the lion’s share of demand.

- North America is the most active region, holding nearly half of the global market.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-geothermal-power-market/free-sample/

Key Market Segments:

By Power Station

- Dry Steam Power Stations

- Flash Steam Power Stations

- Binary Cycle Power Stations

By Power

- Upto 5MW

- Above 5 MW

By Temperature Type

- Low Temperature (Up to 900C)

- Medium Temperature (900C – 1500C)

- High Temperature (Above 1500C)

By End-Use

- Industrial

- Residential

- Commercial

DORT Analysis

Drivers

- Stable baseload generation: High-temperature resources (150 °C+) enable reliable 24/7 power, increasing appeal versus intermittent renewables.

- Mature flash steam technology: Proven efficiency, especially in regions with deep geothermal reservoirs.

- Industrial demand: Heavy industries require continuous power/heating, making geothermal a strong match.

- Regional investments: North America’s robust policy incentives (tax credits, R&D) drive significant capacity growth.

Opportunities

- Capacity expansion: Small-scale (<5 MW) plants are prevalent but scalable to larger modular setups.

- Emerging markets: Countries with untapped high-temperature sites hold potential for newcomers.

- Tech crossover: Expertise from oil & gas can transfer to geothermal exploration and drilling.

- Industrial partnerships: Off-takers in industrial sectors promise long-term agreements and stability.

Restraints

- High capital expenditure: Flash steam plants require complex drilling and infrastructure investment.

- Resource risk: Suitable deep high-temperature reservoirs are unevenly distributed and require exploration.

- Regulatory hurdles: Permitting, environmental reviews, and land use regulations vary and can delay projects.

- Skill shortage: Highly specialized workforce needed for plant operation and geothermal engineering.

Trends

- Continued dominance of flash steam (>59%).

- Small-scale projects (<5 MW) remain strong (~87.6%).

- High-temperature resource utilization stays prominent (~74.5%).

- Industrial end-use leads (~65.9%).

- North America remains the top region (≈48.6%).

By Power Station

Flash Steam Power Stations dominate with 59.4% in 2024 due to high energy efficiency and wide deployment in geothermal-rich regions.

In 2024, Flash Steam Power Stations held a dominant market position, capturing more than a 59.4% share of the global geothermal power market. This significant share can be linked to the technology’s proven efficiency in harnessing high-temperature geothermal resources, particularly in regions like the United States, Indonesia, and the Philippines where geothermal reservoirs exceed 180°C. Flash steam systems are preferred for large-scale geothermal electricity generation as they offer better energy conversion efficiency compared to dry steam or binary cycle systems.

The technology works by separating steam from hot water under high pressure and then flashing it to produce usable steam to drive turbines, making it highly effective in mature geothermal fields. The strong presence of flash steam installations in North America and Southeast Asia continues to anchor their market lead. This technology is expected to maintain its leadership into 2025, supported by both government-backed renewable energy targets and steady advancements in geothermal drilling methods.

By Power

Upto 5MW leads the market with 87.6% share in 2024, driven by rising adoption of small-scale geothermal systems.

In 2024, Upto 5MW held a dominant market position, capturing more than an 87.6% share of the global geothermal power market by capacity segment. This remarkable dominance is largely due to the increasing use of small-scale geothermal plants for decentralized power generation, especially in remote and rural areas. These compact systems are cost-effective, easier to deploy, and require less infrastructure compared to larger installations, making them ideal for local grids and off-grid applications.

Countries with limited access to large power stations, such as Kenya, Turkey, and parts of Southeast Asia, are actively turning to sub-5MW geothermal units to meet local electricity needs sustainably. Additionally, government incentives and policy frameworks in developing nations have encouraged community-level renewable projects, further boosting the demand for this capacity range. The strong performance of this segment is expected to continue into 2025 as clean energy access and rural electrification remain high on the global energy agenda.

By Temperature Type

High Temperature (Above 150°C) leads with 74.5% share in 2024, fueled by its suitability for large-scale electricity generation.

In 2024, High Temperature (Above 150°C) held a dominant market position, capturing more than a 74.5% share of the global geothermal power market by temperature type. This strong lead is attributed to the efficiency and energy yield of high-temperature geothermal reservoirs, which are essential for flash steam and dry steam power generation. These systems are most effective when tapping into geothermal resources with temperatures above 150°C, commonly found in volcanic regions such as the Ring of Fire.

Countries like the United States, Indonesia, and Mexico heavily rely on these high-temperature zones to produce bulk geothermal electricity. The high energy conversion efficiency and ability to support utility-scale plants make this segment highly attractive for both public and private energy projects. In 2025, this trend is expected to continue, supported by expanding exploration activities and improved drilling technologies targeting deep, high-heat geothermal fields.

By End-Use

Industrial sector dominates with 65.9% share in 2024, driven by high energy demand and continuous operations.

In 2024, Industrial held a dominant market position, capturing more than a 65.9% share of the global geothermal power market by end-use. This dominance is mainly due to the sector’s constant need for reliable and cost-effective power to support round-the-clock operations. Industries such as mining, food processing, and manufacturing benefit from geothermal energy’s stable output, especially in areas with rich geothermal resources.

The use of geothermal heat for drying, chemical processing, and steam generation has become increasingly popular as companies look for ways to reduce their carbon emissions and energy costs. In countries like Iceland and the Philippines, geothermal power plays a direct role in powering industrial clusters, offering both electricity and direct heat. By 2025, the demand from the industrial sector is expected to grow further, backed by environmental regulations and the push toward energy transition in heavy industries.

Market Key Players:

- Iberdrola

- RWE

- SolarEdge Technologies

- NextEra Energy

- China Longyuan Power Group

- Siemens Gamesa Renewable Energy

- China Three Gorges Corporation

- Orsted

- EDP Renewables

- GE Renewable Energy

- Canadian Solar

- First Solar

- Brookfield Renewable Partners

- Vestas Wind Systems

- Enel