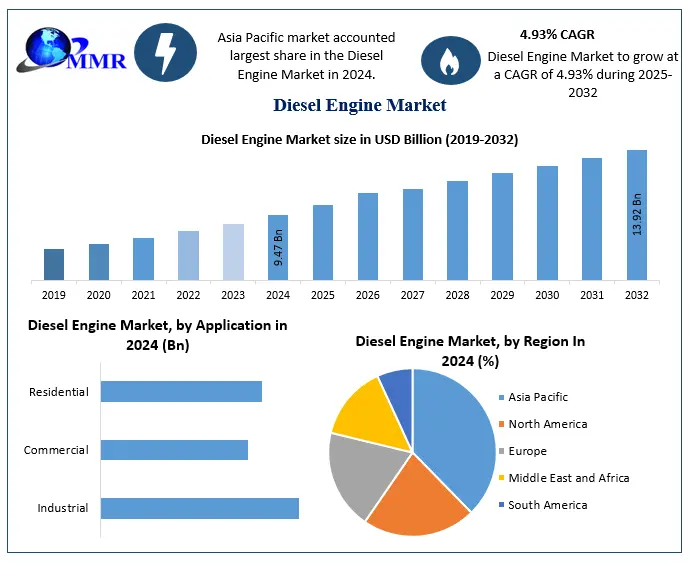

The Diesel Engine Market size was valued at USD 9.47 Billion in 2024 and the total Diesel Engine revenue is expected to grow at a CAGR of 4.93% from 2025 to 2032, reaching nearly USD 13.92 Billion.

𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐌𝐞𝐭𝐡𝐨𝐝𝐨𝐥𝐨𝐠𝐲:

The demand for diesel engines remains resilient across various industries, particularly in regions where electrification is still in its early stages. Sectors such as transportation, agriculture, marine, construction, and mining rely heavily on diesel engines due to their proven reliability, high torque output, and operational efficiency in harsh conditions. The growth of global trade, expansion of infrastructure development, and increased mechanization in farming are amplifying the demand for medium- and heavy-duty diesel engines. Furthermore, the growing need for backup power in remote and off-grid areas, especially in developing countries, continues to drive significant demand for diesel generators, strengthening the market’s global footprint..

Get a sample of the report: https://www.maximizemarketresearch.com/request-sample/14704/

Market Drivers

- 1. Industrialization and Infrastructure Development

- The resurgence of infrastructure development, especially in emerging economies across Asia Pacific, Latin America, and Africa, is bolstering the demand for diesel-powered machinery and vehicles. Equipment such as excavators, bulldozers, loaders, and dump trucks require high-torque engines capable of withstanding rugged terrains and long operational hours—conditions where diesel engines excel.

- 2. Reliability in Remote and Off-Grid Applications

- Diesel engines are a preferred choice in remote areas where electric power sources remain unreliable or unavailable. Diesel-powered generators and pump sets are widely used for consistent power supply in agriculture, construction sites, mining operations, and emergency backup systems, further reinforcing their market presence.

- 3. Rising Marine and Commercial Vehicle Applications

- The marine industry and commercial trucking sector rely heavily on diesel engines for propulsion and auxiliary power. From cargo ships to fishing vessels and logistics trucks, diesel’s ability to deliver long-range travel, efficiency under load, and better lifecycle economics continues to favor its adoption, even as emission standards tighten.

- 4. Technological Advancements and Fuel Innovations

- Modern diesel engines are no longer the smoke-belching powerplants of the past. Innovations in turbocharging, direct fuel injection, after-treatment systems, and hybrid diesel-electric integrations have significantly improved fuel efficiency and emissions. Additionally, the use of bio-diesel blends and synthetic diesel fuels is gaining momentum, aligning the industry with sustainability goals.

Challenges in the Market

- 1. Stringent Emission Regulations

- The most formidable challenge facing the diesel engine industry is the stringent regulatory environment surrounding emissions. Standards such as Euro VI, EPA Tier 4, BS-VI, and China VI impose strict NOx and particulate matter (PM) limits, compelling manufacturers to invest in sophisticated emission control technologies like Selective Catalytic Reduction (SCR) and Diesel Particulate Filters (DPF).

- 2. Growing Shift Toward Electrification

- The global push toward decarbonization has accelerated the adoption of electric vehicles (EVs), battery-powered machinery, and hydrogen fuel cell alternatives, especially in urban transit and light-duty segments. While diesel engines remain dominant in heavy-duty and high-torque use cases, their share in urban transport and short-haul logistics is gradually shrinking.

- 3. High Cost of Compliance

Meeting updated emission norms significantly increases engine design complexity and manufacturing costs. The addition of components such as advanced exhaust gas recirculation (EGR) systems, after-treatment units, and control modules not only raises capital expenses but also escalates maintenance demands—affecting cost-sensitive markets.

Segmentation Analysis

By Type

- Two-Stroke Diesel Engines

- Four-Stroke Diesel Engines (dominant segment)

- Four-stroke engines dominate the market owing to their higher efficiency, lower emissions, and wider application across commercial vehicles, generators, and industrial equipment.

By Power Rating

- Below 100 HP

- 100–500 HP

- 500–1000 HP

- Above 1000 HP

Engines ranging from 100–500 HP account for a major share, being widely used in commercial vehicles and construction equipment. However, engines above 1000 HP are crucial in marine, mining, and power generation segments.

By End-Use Industry

- Automotive (Commercial Vehicles, Buses)

- Construction & Mining

- Marine

- Power Generation

- Agriculture

- Industrial

The automotive segment remains the largest contributor, especially due to the proliferation of heavy-duty trucks and buses in developing economies. The marine segment is also expected to grow steadily, driven by international trade and shipping operations.

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Asia Pacific leads the market, driven by high demand from China, India, Japan, and Southeast Asia. Rapid urbanization, industrial expansion, and large-scale agricultural activities continue to sustain diesel engine consumption in the region.

Regional Insights

North America

- In North America, diesel engine demand remains strong in sectors such as trucking, farming, oil & gas, and emergency backup power. However, increased regulatory scrutiny and incentives for electric mobility are pressuring market players to innovate or diversify.

Europe

- Europe’s diesel engine market is under transformation. The region is shifting aggressively toward electric vehicles, particularly in the passenger car segment. However, diesel remains relevant in logistics, marine, and off-highway applications. The focus here is on low-emission diesel technologies, hybridization, and cleaner fuels.

Asia Pacific

- Asia Pacific is a growth hub. Government spending on infrastructure, vast agricultural economies, and a large base of small and medium-scale industries drive diesel engine deployment. Manufacturers are localizing production and offering value-engineered engines to address cost sensitivity.

Middle East & Africa

- Diesel engines are indispensable across the Middle East and Africa, where extreme climates, rugged landscapes, and limited grid connectivity make them a preferred choice in power generation, water pumping, and transportation.

Competitive Landscape

- The diesel engine market is moderately consolidated, with several global players holding strong regional positions. Key companies are investing in R&D, strategic partnerships, and emission-compliant technologies to maintain competitiveness.

Key Players:

- Caterpillar Inc.

- Cummins Inc.

- MAN Energy Solutions

- Yanmar Holdings Co., Ltd.

- Volvo Penta

- Deutz AG

- Kubota Corporation

- Perkins Engines Company Limited

- Mitsubishi Heavy Industries, Ltd.

- Rolls-Royce Power Systems (MTU)

- Most of these companies are focused on diversifying into hybrid and dual-fuel engine offerings, expanding their presence in the Asia Pacific and Africa regions, and leveraging digital diagnostics and predictive maintenance technologies.

Recent Developments

- Cummins Inc. unveiled its fuel-agnostic engine platform in 2024, capable of running on diesel, natural gas, or hydrogen-derived fuels with minimal structural modifications.

- Volvo Penta expanded its hybrid marine engine lineup, offering reduced emissions and better energy management for ship operators.

- Caterpillar announced investments in advanced combustion engines integrated with IoT and AI-based engine monitoring solutions for predictive maintenance.

- Perkins Engines introduced a range of EU Stage V compliant engines targeted at OEMs in Europe, focusing on high-efficiency fuel combustion.

Future Outlook

- The diesel engine market stands at a pivotal juncture. While the momentum for alternative fuels and electrification is growing, the role of diesel in industrialization, global logistics, and large-scale power needs remains critical.

- The future of diesel engines will likely center on:

- Lower-emission diesel variants

- Hybrid and dual-fuel models

- Synthetic and renewable diesel fuels

- Integration with AI-based diagnostics

- Market localization in developing regions

- With governments tightening emission laws and industries demanding operational efficiency, diesel engine manufacturers must align their innovation strategies with sustainability goals while addressing global power and mobility demands.

Conclusion

- In the face of environmental concerns and technological disruption, the diesel engine market remains resilient and adaptive. By embracing cleaner combustion technologies, investing in hybrid systems, and exploring sustainable fuel sources, market players can unlock new growth avenues. As global economies expand and infrastructure demands escalate, diesel engines will continue to play a vital role—evolving not only as a symbol of mechanical power but also as a cornerstone of energy transition strategies

About Maximize Market Research:

Maximize Market Research is a multifaceted market research and consulting company with professionals from several industries. Some of the industries we cover include medical devices, pharmaceutical manufacturers, science and engineering, electronic components, industrial equipment, technology and communication, cars and automobiles, chemical products and substances, general merchandise, beverages, personal care, and automated systems. To mention a few, we provide market-verified industry estimations, technical trend analysis, crucial market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

Contact Maximize Market Research:

3rd Floor, Navale IT Park, Phase 2

Pune Bangalore Highway, Narhe,

Pune, Maharashtra 411041, India

sales@maximizemarketresearch.com

+91 96071 95908, +91 9607365656