Report Overview:

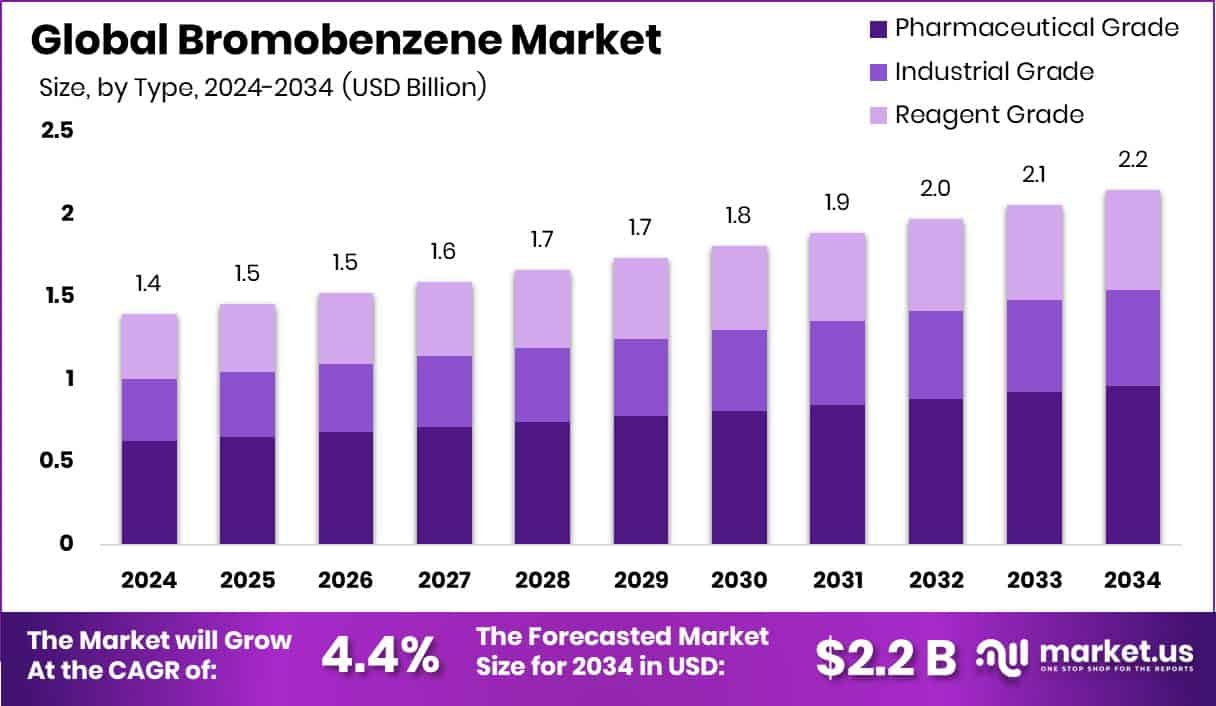

The global bromobenzene market is set to grow steadily, projected to move from around USD 1.4 billion in 2024 to nearly USD 2.2 billion by 2034, showing a CAGR of 4.4% over the forecast period. This growth is largely driven by strong demand from the pharmaceutical and agrochemical industries, especially in fast-developing regions like Asia-Pacific, which currently holds over 56% of the market share.

Within the market, pharmaceutical-grade bromobenzene is leading, making up 44.8% of product types, while high-purity grades (≥99%) dominate in terms of quality, accounting for 67.3% of usage. Applications as solvents also take up a notable portion 36.1%, reflecting its broad utility. The pharma sector alone consumes nearly half (48.5%) of all bromobenzene produced, indicating its critical role in chemical synthesis and intermediate processing.

Global Bromobenzene Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.4 billion in 2024, and grow at a CAGR of 4.4% from 2025 to 2034. Strong industrial growth in Asia-Pacific supports its 56.9% market dominance globally.

Bromobenzene is an aromatic organic compound with the formula C₆H₅Br. It consists of a benzene ring bonded to a single bromine atom. This colorless liquid is widely used as an intermediate in organic synthesis, particularly for making Grignard reagents, which are essential in forming carbon-carbon bonds in various chemical reactions.

The bromobenzene market encompasses the global production, distribution, and consumption of bromobenzene across various industries. This market includes suppliers of raw materials, chemical manufacturers, and end users in sectors like pharmaceuticals, agrochemicals, and electronics. The market is shaped by demand trends, technological advancements, environmental regulations, and the availability of raw materials such as bromine and benzene.

The growth of the bromobenzene market is primarily driven by the increasing demand for pharmaceutical intermediates and fine chemicals. As the pharmaceutical sector expands, especially in developing regions, the need for brominated compounds in drug synthesis is rising steadily. Additionally, technological improvements in chemical manufacturing are making bromobenzene production more efficient and environmentally sustainable, encouraging wider adoption.

Demand for bromobenzene remains stable due to its versatile applications in laboratory and industrial processes. Its use in creating Grignard reagents ensures continued demand from research institutions and chemical producers. The expanding chemical and material science sectors further strengthen the demand base, especially as more customized organic compounds are being developed.

Key Takeaways

-

Market projected to reach USD 2.2 billion by 2034, up from USD 1.4 billion in 2024.

-

Pharmaceutical-grade accounts for 44.8% of the product type segment.

-

High-purity bromobenzene (≥99%) leads with a 67.3% share.

-

Used mainly as a solvent (36.1%) in applications.

-

Pharmaceuticals are the biggest end users, making up 48.5% of demand.

-

Asia-Pacific is the largest and fastest-growing regional market.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/bromobenzene-market/free-sample/

Key Market Segments:

By Type

- Pharmaceutical Grade

- Industrial Grade

- Reagent Grade

By Purity

- <99%

- ≥99%

By Application

- Solvent

- Chemical Intermediate

- Grignard Reagent

- Others

By End-Use

- Pharmaceuticals

- Agrochemicals

- Chemicals

- Others

DORT Analysis

Market Key Players:

- Aarnee International

- Aarti Industries

- Chemcon Speciality Chemicals Limited

- Haihang Industry Co., Ltd

- Heranba Industries Ltd.

- Lanxess

- Merck KGaA

- Pragna Group

- Sandoo Pharmaceuticals and Chemicals Co., Ltd.

- Yancheng Longshen Chemical Co., Ltd.

- Yogi Intermediates PVT. LTD.

- Yurui (shanghai) chemical Co., Ltd