Report Overview:

The bio-based polyurethane market is on an impressive growth trajectory, with global revenues projected to rise from roughly USD 39.8 million in 2023 to around USD 84.3 million by 2033, reflecting a strong CAGR of 7.8%

This surge is rooted in increasing demand from green-building construction and automotive sectors, where these eco-friendly coatings, foams, and adhesives are becoming essential. The move away from traditional petroleum-based PU largely due to its toxicity, non-biodegradability, and reliance on oil creates a compelling case for bio-based alternatives

Key Takeaways:

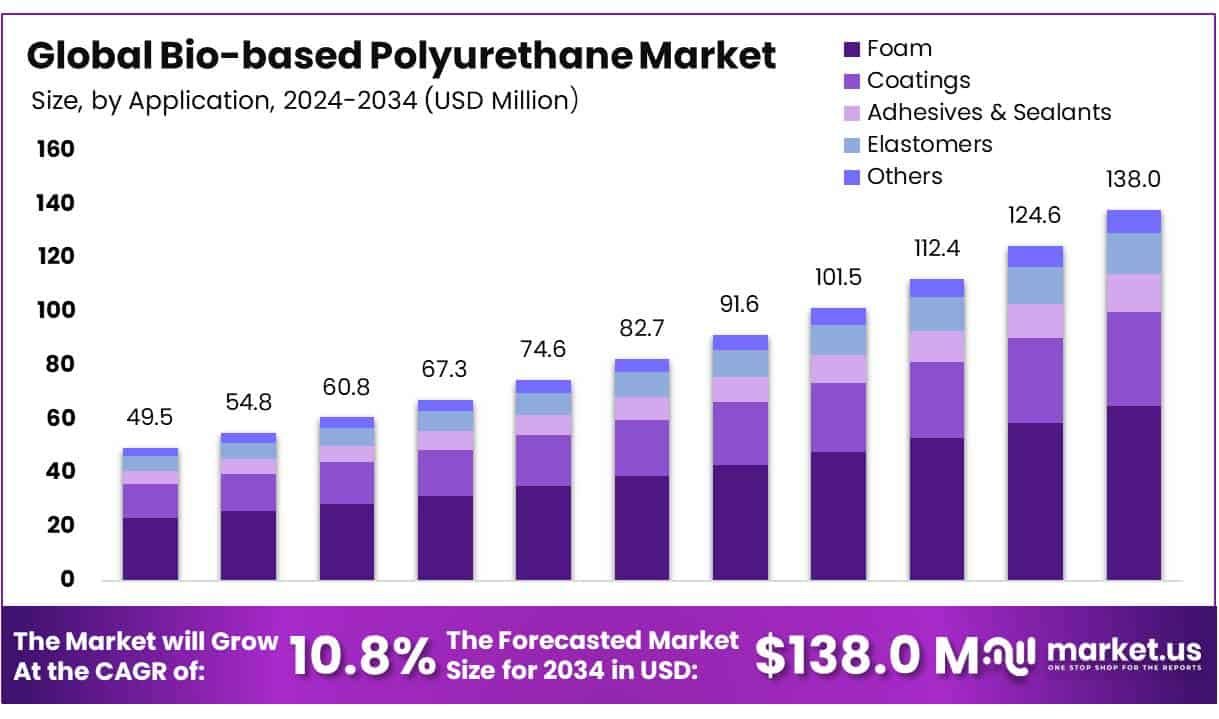

- The global bio-based polyurethanes market was valued at US$ 49.5 million in 2024.

- The global bio-based polyurethanes market is projected to grow at a CAGR of 10.8% and is estimated to reach US$ 138 million by 2034.

- By application, foam accounted for the largest market share of 47.10%. Driven by its widespread use in automotive, construction, and furniture due to its insulation, lightweight, and energy-efficient properties.

- By end-use, building & construction accounted for the majority of the market share at 37.20%. Due to its demand for sustainable materials in insulation, coatings, and sealants

- North America is estimated as the largest market for Bio-based Polyurethanes with a share of 44.40% of the market share. Due to stringent environmental regulations, technological advancements, and growing demand for sustainable materials across industries like automotive, construction, and furniture.

- The polyurethane market is growing globally due to increasing demand for energy-efficient materials, advancements in sustainable technologies, expanding applications in construction, automotive, and packaging industries, and the rising adoption of eco-friendly and bio-based alternatives.

![]()

Download Exclusive Sample Of This Premium Report:

https://market.us/report/bio-based-polyurethane-market/free-sample/

Key Market Segments:

By Application

- Foam

- Rigid

- Flexible

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

By End-use

- Building & Construction

- Automotive

- Footwear

- Electrical & Electronics

- Packaging

- Textiles

- Others

Drivers:

The main engine behind this market’s momentum is the global push for sustainability. Renewable raw materials such as oils from soybean, castor, and sunflower are attracting interest as healthier, greener alternatives to petrochemicals .

In addition, tightening regulations around emissions and waste are encouraging industries to switch to bio-based PU. Together with rising consumer demand for environmentally responsible products, these factors are amplifying investments and innovation in this space

Opportunities:

There’s fertile ground ahead. Innovations in bio-polyol technology are making it cheaper and more scalable, which opens doors across various applications like medical devices, electronics, and niche vehicle components

Plus, as more governments roll out green incentives, companies have a chance to expand their portfolios and tap new markets from construction to automotive and packaging with bio-based PU at the center

Restraints:

However, cost remains a sticking point. Bio-based PU still costs more to produce than traditional PU, and scaling up requires investment in sourcing and manufacturing capacity . Another issue is raw material variability: supply chains tied to plant oils can be unpredictable and price-sensitive, which could affect consistency in product quality .

Trends:

The market also faces external threats. If crude oil prices drop or petrochemical PU manufacturers ramp up sustainable claims (greenwashed or not), bio-based PU could lose competitiveness.

Climate-related disruptions affecting crop yields could further squeeze bio-feedstocks. Finally, without consistent regulations or certification standards across regions, there’s a risk of fragmented adoption and potential backlash over misleading claims.

Market Key Players:

- BASF SE

- Covestro AG

- Cargill, Incorporated

- Huntsman International LLC

- The Lubrizol Corporation

- MITSUI & CO., LTD.

- Arkema

- Miracll Chemicals Co. Ltd

- Stahl Holdings BV

- Rampf Group

- Epaflex

- MCPU Polymer Engineering

- Other Key Players

Conclusion:

In short, the bio-based polyurethane market is entering an exciting phase. With the world focused on climate change, this greener alternative is carving out space in major industries like construction and automotive.

Technological strides and policy support are steadily bridging gaps in cost and quality, making it more practical for manufacturers to choose sustainability without sacrificing performance.

Report Overview:

The bio-based polyurethane market is on an impressive growth trajectory, with global revenues projected to rise from roughly USD 39.8 million in 2023 to around USD 84.3 million by 2033, reflecting a strong CAGR of 7.8%

This surge is rooted in increasing demand from green-building construction and automotive sectors, where these eco-friendly coatings, foams, and adhesives are becoming essential. The move away from traditional petroleum-based PU largely due to its toxicity, non-biodegradability, and reliance on oil creates a compelling case for bio-based alternatives

Key Takeaways:

- The global bio-based polyurethanes market was valued at US$ 49.5 million in 2024.

- The global bio-based polyurethanes market is projected to grow at a CAGR of 10.8% and is estimated to reach US$ 138 million by 2034.

- By application, foam accounted for the largest market share of 47.10%. Driven by its widespread use in automotive, construction, and furniture due to its insulation, lightweight, and energy-efficient properties.

- By end-use, building & construction accounted for the majority of the market share at 37.20%. Due to its demand for sustainable materials in insulation, coatings, and sealants

- North America is estimated as the largest market for Bio-based Polyurethanes with a share of 44.40% of the market share. Due to stringent environmental regulations, technological advancements, and growing demand for sustainable materials across industries like automotive, construction, and furniture.

- The polyurethane market is growing globally due to increasing demand for energy-efficient materials, advancements in sustainable technologies, expanding applications in construction, automotive, and packaging industries, and the rising adoption of eco-friendly and bio-based alternatives.

![]()

Download Exclusive Sample Of This Premium Report:

https://market.us/report/bio-based-polyurethane-market/free-sample/

Key Market Segments:

By Application

- Foam

- Rigid

- Flexible

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

By End-use

- Building & Construction

- Automotive

- Footwear

- Electrical & Electronics

- Packaging

- Textiles

- Others

Drivers:

The main engine behind this market’s momentum is the global push for sustainability. Renewable raw materials such as oils from soybean, castor, and sunflower are attracting interest as healthier, greener alternatives to petrochemicals .

In addition, tightening regulations around emissions and waste are encouraging industries to switch to bio-based PU. Together with rising consumer demand for environmentally responsible products, these factors are amplifying investments and innovation in this space

Opportunities:

There’s fertile ground ahead. Innovations in bio-polyol technology are making it cheaper and more scalable, which opens doors across various applications like medical devices, electronics, and niche vehicle components

Plus, as more governments roll out green incentives, companies have a chance to expand their portfolios and tap new markets from construction to automotive and packaging with bio-based PU at the center

Restraints:

However, cost remains a sticking point. Bio-based PU still costs more to produce than traditional PU, and scaling up requires investment in sourcing and manufacturing capacity . Another issue is raw material variability: supply chains tied to plant oils can be unpredictable and price-sensitive, which could affect consistency in product quality .

Trends:

The market also faces external threats. If crude oil prices drop or petrochemical PU manufacturers ramp up sustainable claims (greenwashed or not), bio-based PU could lose competitiveness.

Climate-related disruptions affecting crop yields could further squeeze bio-feedstocks. Finally, without consistent regulations or certification standards across regions, there’s a risk of fragmented adoption and potential backlash over misleading claims.

Market Key Players:

- BASF SE

- Covestro AG

- Cargill, Incorporated

- Huntsman International LLC

- The Lubrizol Corporation

- MITSUI & CO., LTD.

- Arkema

- Miracll Chemicals Co. Ltd

- Stahl Holdings BV

- Rampf Group

- Epaflex

- MCPU Polymer Engineering

- Other Key Players

Conclusion:

In short, the bio-based polyurethane market is entering an exciting phase. With the world focused on climate change, this greener alternative is carving out space in major industries like construction and automotive.

Technological strides and policy support are steadily bridging gaps in cost and quality, making it more practical for manufacturers to choose sustainability without sacrificing performance.