Report Overview:

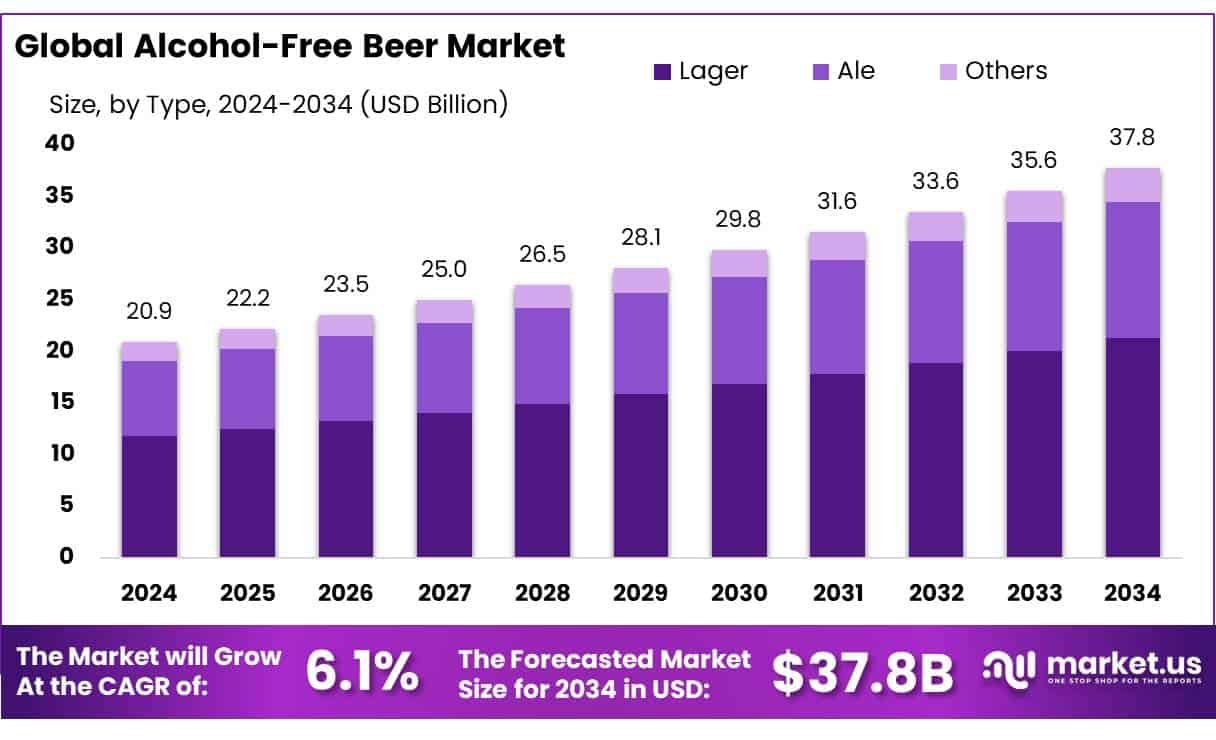

The global alcohol-free beer market is experiencing significant growth, driven by shifting consumer preferences towards healthier lifestyles and moderation in alcohol consumption. In 2024, the market was valued at approximately USD 20.9 billion and is projected to reach USD 37.8 billion by 2034, reflecting a compound annual growth rate (CAGR) of around 6.1% .

This market expansion is largely attributed to the increasing demand for non-alcoholic beverages that offer the taste and experience of traditional beer without the associated health risks. Major breweries are investing in product innovation and marketing strategies to cater to this growing consumer base.

The alcohol-free beer market is gaining strong traction globally as health and wellness trends reshape consumer choices. More people are turning to non-alcoholic options, driven by fitness goals, religious restrictions, or a simple desire to avoid intoxication.

Alcohol-free beer, also known as non-alcoholic beer, contains little to no alcohol (usually below 0.5% ABV). It appeals to a broad audience—from designated drivers to those abstaining from alcohol entirely. The market is being reshaped by lifestyle changes, younger consumer preferences, and corporate wellness initiatives. Big brands are investing in marketing these products as refreshing, healthy alternatives, breaking the stigma that alcohol-free beer is inferior in taste.

Key Takeaways:

- In 2024, the global alcohol-free beer market was valued at US$ 20.9 Billion

- Among product types, the lager held the majority of the revenue share at 56.4%

- Based on category, plain alcohol-free beer accounted for the largest market share with 73.4%

- By production method, the physical process segment dominated the global market with 65.4% market share in 2024

- Among packaging type, can packaging dominated the market with significant market share of 57.1%

- By distribution channel, supermarkets & hypermarkets held majority of market share at 42.3%

- Based on age group, 26-35 years segment accounted for 37.3% of the market revenue share

- Among end-user, male segment accounted for the majority of the alcohol-free beer market share with 58.6%

- In 2024, North America dominated the global market with significant market share of 46.3%

![]()

𝐂𝐥𝐢𝐜𝐤 𝐭𝐨 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐧𝐝 𝐃𝐫𝐢𝐯𝐞 𝐈𝐦𝐩𝐚𝐜𝐭𝐟𝐮𝐥 𝐃𝐞𝐜𝐢𝐬𝐢𝐨𝐧𝐬:

https://market.us/report/global-alcohol-free-beer-market/free-sample/

Key Market Segments:

By Product Type

- Lager

- Ale

- Other

By Category

- Plain

- Flavor

By Production Type

- Physical

- Thermal

- Membrane

- Others

- Biological

- Traditional

- Continuous Fermentation

By Packaging Type

- Can

- Bottles

Based on Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

By Age Group

- 18-25 Years

- 26-35 Years

- 36-45 Years

- Above 46 Years

Based on End-users

- Male

- Female

Drivers:

The primary drivers include increasing health consciousness, changing social norms favoring moderation, and advancements in brewing technologies that enhance the taste and quality of alcohol-free beers.

The surge in health consciousness and the desire for low or no-alcohol beverages are primary drivers. Younger consumers, particularly millennials and Gen Z, are increasingly opting for healthier lifestyles, contributing to market growth .

Opportunities:

There is significant potential in expanding product lines to include a variety of flavors and functional ingredients, targeting health-conscious consumers. Additionally, tapping into emerging markets and leveraging online retail channels can further boost market growth.

Innovations in brewing technology and flavor development present opportunities for market expansion. The rise of zero-alcohol bottle shops and increased availability in mainstream retail outlets also offer growth prospects

Restraints:

Challenges such as the higher cost of production, taste perceptions, and limited awareness in certain regions may hinder market expansion.

High production costs and limited consumer awareness in certain regions may hinder market growth. Additionally, the perception of alcohol-free beer as inferior in taste compared to traditional beer can be a barrier.

Trends:

The market is witnessing trends like the introduction of premium non-alcoholic beers, collaborations with health and wellness brands, and increased marketing efforts focusing on the benefits of alcohol-free consumption.

The introduction of tariffs, such as the 25% U.S. tariff on imported beer, including alcohol-free variants, poses a threat by potentially increasing prices and affecting demand

Market Key Players:

- Bavarian State Brewery Weihenstephan

- Anheuser-Busch InBev

- Heineken N.V.

- Coors Brewing Company

- BERNARD Family Brewery, a.s.

- Athletic Brewing Company

- Moscow Brewing Company

- Big Drop Brewing Pty Ltd

- Carlsberg Breweries A/S

- Bravus Brewing Company

- Brooklyn Brewery

- ERDINGER Weißbier

- Krombacher Startseite

- Swinkels Family Brewers

- Other Key Players

Conclusion:

The alcohol-free beer market is poised for continued growth, supported by evolving consumer preferences and industry innovations. As health and wellness trends persist, and as breweries continue to refine their offerings, the market is expected to expand, offering diverse and appealing options to a broadening consumer base.

The alcohol-free beer market is poised for robust growth, fueled by health trends, technological advancements, and changing consumer behaviors. While challenges like tariffs and production costs exist, the market’s future looks promising, especially with increasing acceptance among younger demographics and expanding distribution channels. Brands that focus on innovation, quality, and consumer education are likely to thrive in this evolving landscape

The alcohol-free beer market is evolving rapidly, driven by changing perceptions and lifestyle priorities. As more consumers lean toward mindful consumption, the demand for sophisticated, great-tasting non-alcoholic options is only expected to rise. Manufacturers that can innovate while staying true to authentic beer experiences will hold a competitive edge. Looking ahead, this sector not only represents a healthier alternative to traditional beer but is also becoming a symbol of a broader cultural shift toward balanced, conscious living.