Report Overview:

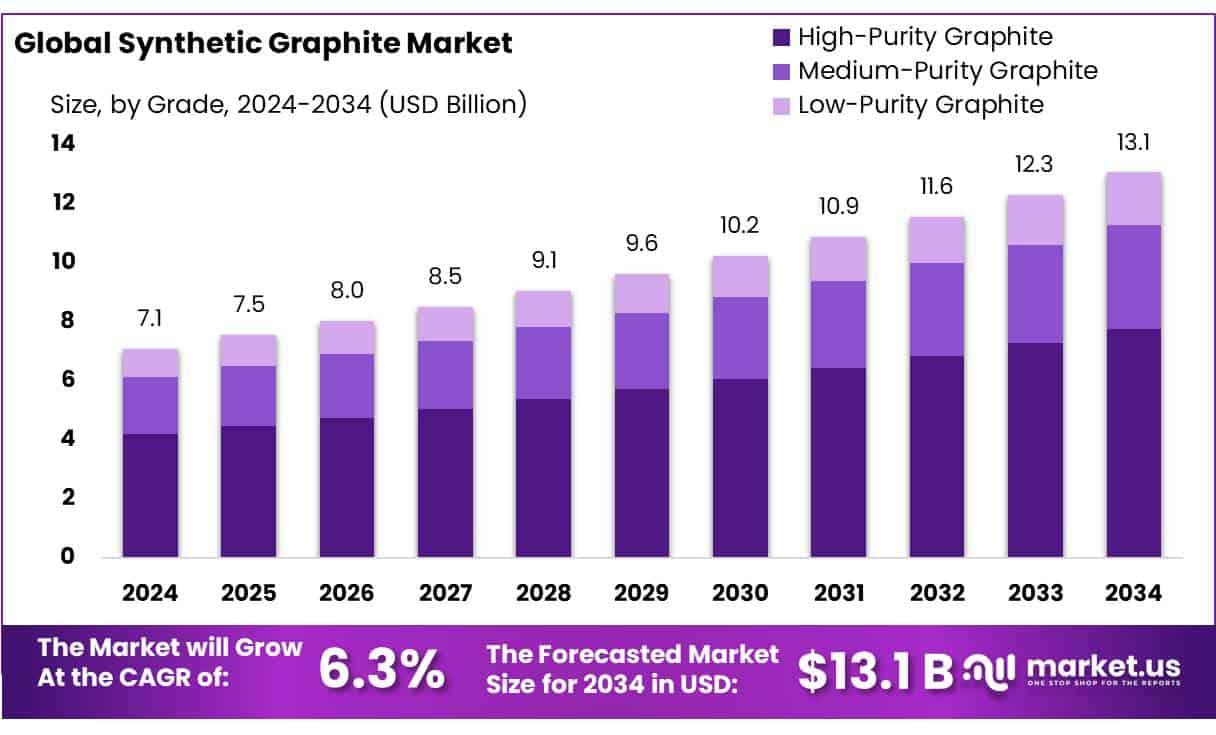

The global synthetic graphite market is set to expand from roughly USD 7.1 billion in 2024 to about USD 13.1 billion by 2034. This reflects a healthy compound annual growth rate (CAGR) of 6.3% over the forecast period. High purity synthetic graphite commands the largest share, making up over 59.3% of the market, thanks to its essential role in high performance applications. Rechargeable batteries represent the dominant application, accounting for approximately 39.1% of global demand driven mainly by electric vehicle (EV) and energy storage system growth. The market’s steady expansion is supported by rising demand across consumer electronics, automotive, industrial machinery, aerospace, and coatings. As manufacturers refine production methods to improve quality and reduce cost, synthetic graphite continues to outpace natural graphite in precision critical uses. Overall, this market is expected to maintain steady growth fueled by expanding battery markets and technological progress in materials.

The global synthetic graphite market is set to expand from roughly USD 7.1 billion in 2024 to about USD 13.1 billion by 2034. This reflects a healthy compound annual growth rate (CAGR) of 6.3% over the forecast period. High purity synthetic graphite commands the largest share, making up over 59.3% of the market, thanks to its essential role in high performance applications. Rechargeable batteries represent the dominant application, accounting for approximately 39.1% of global demand driven mainly by electric vehicle (EV) and energy storage system growth. The market’s steady expansion is supported by rising demand across consumer electronics, automotive, industrial machinery, aerospace, and coatings. As manufacturers refine production methods to improve quality and reduce cost, synthetic graphite continues to outpace natural graphite in precision critical uses. Overall, this market is expected to maintain steady growth fueled by expanding battery markets and technological progress in materials.

Synthetic graphite concentrates are high-purity carbon materials produced through the refining of petroleum coke or coal tar pitch via graphitization at temperatures exceeding 2,500°C. This industrial product offers exceptional electrical conductivity, thermal stability, and structural uniformity, rendering it indispensable in applications such as Lithiumion battery anodes, semiconductor manufacturing, steelmaking refractories, and aerospace components. In 2022, global consumption of all graphite types exceeded 1.3 million metric tons, with synthetic graphite accounting for approximately 67% of total kg consumption—principal demand originating from Asia.

The EV revolution is the primary growth driver; over 65 percent of synthetic graphite demand is linked to EV batteries. The U.S. DOE recently backed Novonix’s Chattanooga plant with a conditional USD 754 million loan to establish a 31,500 tpa capacity facility, with plans to scale to 75,000 tpa.

Key Takeaways

- Market value projected to rise from USD 7.1 bn (2024) to USD 13.1 bn by 2034, at a 6.3% CAGR.

- High‑purity graphite is leading segment with ~59.3% of market share.

- Rechargeable batteries are the dominant application, ~39.1% share.

- Multiple end‑use sectors drive adoption: EVs, consumer electronics, industrial, aerospace, coatings.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-synthetic-graphite-market/free-sample/

Key Market Segments:

By Grade

- High-Purity Graphite

- Medium-Purity Graphite

- Low-Purity Graphite

By Application

- Rechargeable Batteries

- Fire Retardants

- Coatings

- High-Temperature Resistant Crucibles

- Lubricants

- Others

By End-Use

- Consumer Electronics

- Automotive

- Industrial Machinery

- Aerospace Defense

- Construction

- Others

DORT Analysis

Drivers

- Strong demand from EV and energy storage markets fuels growth of battery‑grade synthetic graphite.

- Preference for high purity grades in precision applications supports price stability and margins.

- Growth in consumer electronics and industrial machinery further boosts demand.

- Technological improvements in consistency, thermal and electrical conductivity increase adoption in advanced sectors.

Opportunities

- Expansion into fast growing battery markets worldwide offers room for new producers and form improvements.

- Scaling production can reduce unit costs and generate higher returns.

- Entering specialized sectors like aerospace, crucibles, coatings opens new high end revenue streams.

- Innovation in synthesis processes could yield greener, more energy‑efficient graphite options.

Restraints

- High energy consumption in synthetic graphite production keeps costs elevated and may limit margins.

- Strong Chinese dominance in natural graphite can pressure pricing for synthetic alternatives.

- Long lead times and capital intensity of production facilities may deter new entrants.

- Regulatory or environmental restrictions on carbon emissions may raise production compliance costs.

Trends

- Uptake of rechargeable battery use in EVs and grid storage remains central to market growth.

- Growing preference for high purity grade underscores demand in high‑tech sectors.

- Development of greener synthesis routes and recycling methods is gaining traction.

- Producers are investing in process scale‑up to achieve cost advantage and quality consistency.

Market Key Players:

- Asbury Carbons

- Beiterui New Material Group Co. Ltd

- Canada Carbon Inc.

- GrafTech International

- Graphit Kropfmuhl GmbH

- Graphite India

- HEG

- Imerys Graphite & Carbon Ltd.

- Mason Graphite

- Mersen

- Nippon Kokuen Group

- SGL Carbon

- Showa Denko Materials Co., Ltd.

- Tokai Carbon

- XRD Graphite Manufacturing Co., Ltd.