Report Overview:

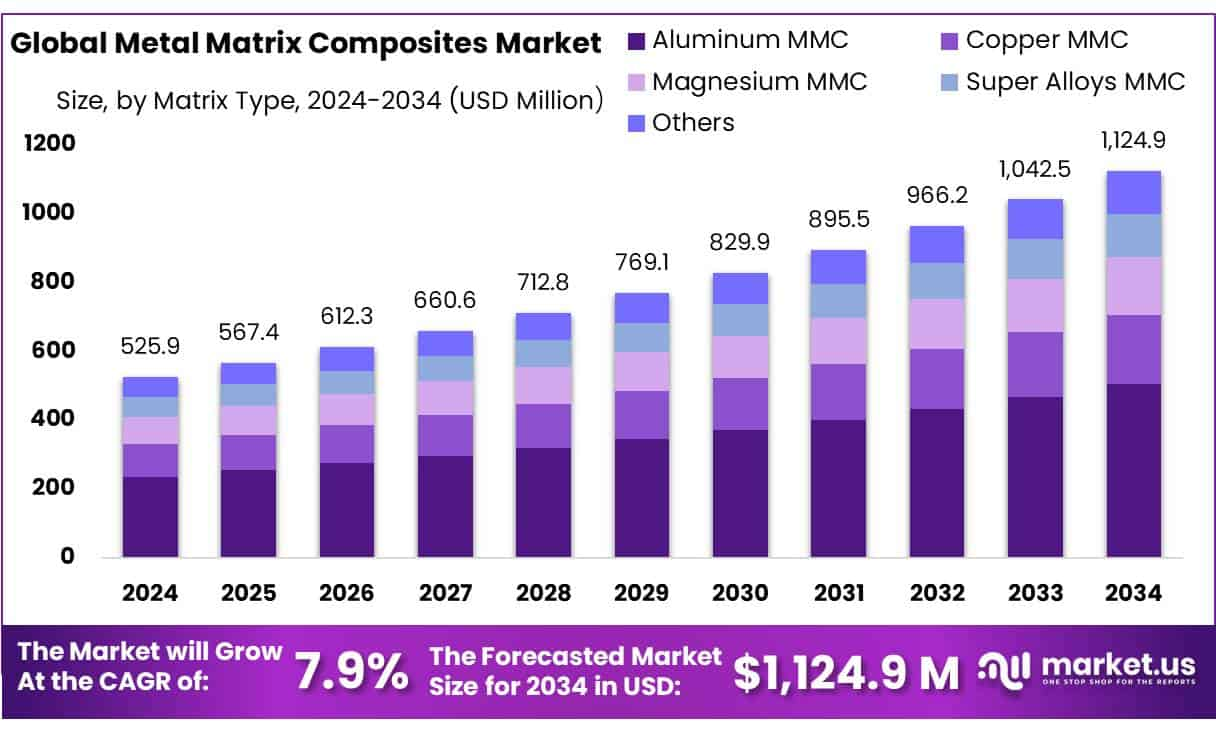

The Metal Matrix Composites market is expected to grow significantly, reaching around USD 1,124.9 million by 2034, up from USD 525.9 million in 2024, reflecting a healthy CAGR of 7.9%. MMCs are materials made by combining metals like aluminum, magnesium, or titanium with reinforcing components such as ceramic fibers or particles. These composites are known for being lightweight yet strong, heat resistant, and more durable than regular metals. Initially used in defense and aerospace, their applications now extend to automotive, electronics, and industrial tools. This growth is backed by rising demand for energy efficiency and improved material performance, especially in sectors aiming to reduce carbon emissions. Government funding in countries like the U.S. and India is also encouraging innovation and large-scale production. North America leads the market with a 42.9% share, and aluminum-based MMCs, with silicon carbide reinforcement, are particularly dominant.

Among different matrix materials, aluminum-based MMCs hold the largest share at 44.9%, mainly because they’re light, corrosion-resistant, and cost-effective perfect for cars, planes, and electronics. Discontinuous reinforcements, like particles and short fibers, make up the majority share (51.4%) due to their simpler, more economical manufacturing processes such as casting and powder metallurgy. Silicon carbide stands out as the most used reinforcement material (45.6%), offering excellent hardness and thermal properties, making it ideal for brake components and heat-conducting applications. Automotive and transportation lead the demand for MMCs, accounting for 44.3% of the market, as the shift to electric vehicles and lighter designs continues. North America dominates this segment, thanks to its strong aerospace and EV industries, and generous funding from agencies like the U.S. Department of Energy (DOE) and the Department of Defense (DoD), which have invested millions into advanced materials research and development.

Key driving factors include escalating demand for lightweight yet durable materials across automotive, aerospace, defense, electronics, and industrial sectors. For instance, MMC integration in automotive components contributes to lighter vehicles and improved energy efficiency, directly aligning with global carbon reduction targets. The U.S. ManTech Composites Institute—a consortium of over 120 members across industry, academia, and government—supports MMC advancement through DoD-funded innovation platforms.

In India, the Defence Research & Development Organisation (DRDO)—with a budget nearing INR 5.94 lakh crore (2023–24)—actively supports domestic R&D into advanced materials like MMCs. Moreover, India’s defence manufacturing output surpassed ₹1.27 lakh crore (FY 2023-24), a significant 60% increase from FY 2019 20, indicating growth in in-house demand for high-performance composites

Government agencies are actively funding R&D and manufacturing scale-up for MMC and related materials. In the U.S., the Department of Energy (DOE) allocated USD 30 million in February 2023 through its Advanced Materials & Manufacturing Technologies Office to support domestic production of lightweight composites, including MMCs. Later, in mid 2024, DOE awarded USD 136 million to support 66 projects targeting energy-efficient industrial technologies and critical materials. Moreover, the National Nanotechnology Initiative fosters cross-agency funding relevant to MMCs via nanoscale material development.

Key Takeaways

-

The global MMC market is projected to double by 2034, reaching USD 1.125 billion, growing at a 7.9% CAGR.

-

Aluminum-based MMCs dominate with a 44.9% share, due to their lightweight and cost-efficient properties.

-

Discontinuous reinforcements account for 51.4% of the market, driven by ease of production.

-

Silicon carbide is the top reinforcement material (45.6%), known for its strength and thermal durability.

-

Automotive and transportation make up 44.3% of demand, with North America leading at 42.9% market share.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/metal-matrix-composites-market/free-sample/

Key Market Segments:

By Matrix Type

- Aluminum MMC

- Copper MMC

- Magnesium MMC

- Super Alloys MMC

- Others

By Reinforcement Type

- Continuous

- Discontinuous

- Particles

By Reinforcement Material

- Alumina

- Silicon Carbide

- Carbon Fiber

- Others

By End-Use

- Automotive & Transportation

- Aerospace & Defense

- Electrical & Electronics

- Others

DORT Analysis

Drivers

• Rising demand for lighter, stronger materials in aerospace and automotive sectors fuels MMC growth.

• Increased government funding from the U.S. DOE and DoD accelerates research and adoption.

• India’s DRDO and public-sector investments are supporting domestic MMC innovation.

• Environmental goals are pushing industries to adopt lighter materials that reduce emissions.

Opportunities

• The electric vehicle boom opens new markets for MMCs in batteries, housings, and heat exchangers.

• Mass-production techniques like casting and powder metallurgy are reducing costs.

• Growth in Asia-Pacific offers high potential due to industrial expansion.

• MMCs are finding new uses in electronics, defense, and renewable energy systems.

Restraints

• MMCs are significantly more expensive than conventional metals, which limits adoption.

• Production methods require specialized technology and trained labor, adding complexity.

• Scaling MMC use in automotive remains difficult due to high integration costs.

• Material sourcing (especially silicon carbide) needs to be stable to avoid supply issues.

Trends

• 3D printing (additive manufacturing) is making MMC production more precise and efficient.

• Research on nanocomposites with carbon nanotubes and boron nitride is gaining traction.

• Sustainable methods like powder metallurgy are becoming more popular.

• Countries like the U.S. and India are investing in joint R&D ventures.

• Mergers and partnerships among key players are driving innovation in the market.

Market Key Players:

- 3M

- ADMA Products Inc.

- Ceram Tec

- CPS Technologies Corporation

- Denka Company Limited

- Destsce Edelstaslwerke GmbH

- Ferrotec Corporation

- Materion Corporation

- MTC Powder Solutions AB

- Plansee Group

- Sumitomo Electric Industries Ltd

- Thermal Transfer Composites LLC

- TISICS Ltd