Report Overview:

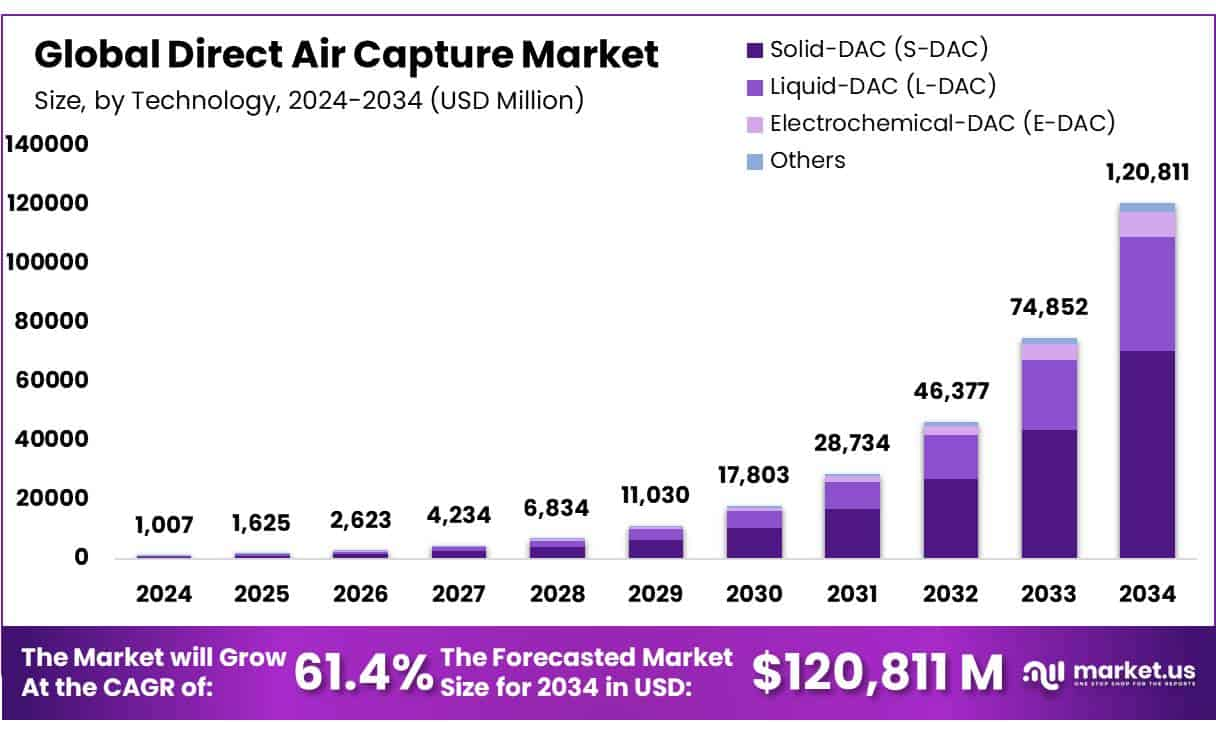

The Direct Air Capture market is projected to grow significantly, reaching an estimated USD 120,811 billion by 2034, up from USD 1,007.1 billion in 2024. This remarkable expansion reflects a CAGR of 61.4% over the forecast period (2025–2034). North America currently leads the global market, commanding a dominant 48.3% share, thanks to its advanced infrastructure, strong policy support, and substantial public and private investment.

DAC technology is gaining traction as a viable tool for large-scale carbon removal, supporting global climate goals and net-zero commitments. The market primarily revolves around two technologies solid and liquid DAC used to extract CO₂ directly from ambient air. Solid-DAC systems, which accounted for 58.3% of the market in 2024, are particularly valued for their modular nature and lower energy consumption. Furthermore, electricity-powered systems make up 68.3% of deployments, aligning with the shift toward clean energy sources.

Smaller-scale plants, particularly those with fewer than ten CO₂ collectors, are growing in popularity due to their lower installation costs and scalability, capturing 46.4% of market installations. Key applications include carbon capture and storage (CCS), which holds 82.1% of usage, especially within the oil & gas sector, which represents 34.5% of the demand.

Key Takeaways:

- The DAC market is forecasted to grow from USD 1,007.1 billion (2024) to USD 120,811 billion (2034) at a CAGR of 61.4%.

- North America leads the market with 48.3% share, supported by infrastructure and policy incentives.

- Solid DAC technology is dominant with 58.3% share, driven by its efficiency and modular structure.

- Electricity-powered DAC systems hold 68.3% market share, in line with decarbonization goals.

- Small-scale DAC units (<10 collectors) account for 46.4%, enabling faster deployment.

- CCS application dominates with 82.1% usage, and oil & gas is the top industry segment at 34.5%.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/direct-air-capture-market/free-sample/

Key Market Segments:

By Technology

- Solid-DAC (S-DAC)

- Liquid-DAC (L-DAC)

- Electrochemical-DAC (E-DAC)

- Others

By Energy Source

- Electricity

- Heat

By Number of Collectors

- Less than 10 collectors

- More than 10 collectors

By Application

- Carbon Capture, and Storage (CCS)

- Carbon Capture Utilization and Storage (CCUS)

By End-Use

- Oil & Gas

- Food and beverage

- Automotive

- Chemicals

- Healthcare

- Others

Technology Analysis

Solid-DAC (S-DAC) Held A Dominant Technology In 2024 Direct Air Capture Market

The direct air capture market is segmented based on technology into solid-DAC, liquid-DAC, electrochemical-DAC, and others. In 2024, the Solid-DAC segment held a significant revenue share of 58.3 %. Solid-DAC uses solid adsorbents, such as amine-based chemisorbents and porous materials such as MOFs and zeolites allow effective CO₂ capture at ambient temperatures with relatively low energy input during regeneration. Additionally, its modular design enables easier scaling and flexibility in deployment, making it more attractive for commercial use. These factors contribute to Solid-DAC’s larger market share and adoption.

Energy Source Analysis

Electricity Leds Energy Source Segment In 2024 Direct Air Capture Market.

Based on energy sources, the market is further divided into electricity and heat. The predominance of electricity, commanding a substantial 68.3% market share in 2024. This predominance is driven by the growing availability of low-carbon and renewable electricity, which aligns with the need to minimize the carbon footprint of DAC operations. Electrically powered systems, particularly those used in Solid-DAC, are more scalable and easier to integrate with renewable energy sources, making them the preferred choice for both environmental and economic reasons.

Number of Collector Analysis

Less Than 10 Collectors Drive The Number Collector Segment In Direct Air Capture Market In 2024

Among several collectors, the direct air capture market is classified into less than 10 collectors, and more than 10 collectors. In 2024, less than 10 collectors held a dominant position with a 46.4% share. Due to the early-stage nature of several DAC projects, which typically begin on a smaller scale to minimize costs and test performance. Smaller installations are easier to deploy, require lower capital investment, and are ideal for pilot programs or localized carbon removal. The flexibility and lower initial investment associated with these systems have driven their adoption in various sectors looking to mitigate their carbon footprint without massive infrastructural changes.

Application Analysis

Carbon Capture, And Storage Dominate The Application Segment In the Direct Air Capture Market.

By application, the market is categorized into Carbon Capture, and Storage (CCS), and Carbon Capture Utilization and Storage (CCUS). The Carbon Capture, and Storage (CCS) segment emerging as the dominant channel, holding 82.1% of the total market share in 2024. Due to the increasing focus on permanent carbon removal as a key strategy to meet global climate goals. CCS provides a reliable method for sequestering captured CO₂ in deep geological formations, ensuring long-term storage.

While CCUS also plays a role by using captured CO₂ in various industrial processes, CCS remains the preferred option for large-scale, durable carbon mitigation. Large-scale carbon removal strategies to achieve global climate targets. The CCS technology has been bolstered by governmental policies and incentives aimed at reducing carbon footprints, making it a preferred choice for industries aiming to comply with environmental regulations.

DORT Analysis

Drivers

Growing global pressure to meet climate targets is pushing industries and governments to invest in carbon removal. Policies like the U.S. 45Q tax credit are offering real financial incentives for DAC project development. Public and private R&D investment estimated at USD 4 billion has made rapid advancements possible. The modular and scalable nature of solid DAC technology lowers the barrier to entry and speeds up deployment.

Opportunities

The ability to repurpose captured CO₂ into fuels, chemicals, and building materials creates valuable commercial use cases. DAC projects that run on clean electricity can appeal to ESG-driven investors. Smaller units allow for flexible deployment across various geographies and industries. Growing interest from the voluntary carbon market opens doors for carbon offset sales. Collaboration with oil, gas, and heavy industries can help scale the technology with large capital inflows.

Restraints

High installation and operational costs remain a key challenge, especially for low-income or emerging markets. The technology is energy-intensive and depends on access to low-carbon electricity to stay environmentally viable. Regulatory uncertainty and lengthy permitting processes can delay projects. Additionally, long-term CO₂ storage and permanence of removal remain under public and scientific scrutiny.

Trends

Solid DAC is emerging as the standard, with growing preference due to performance and scalability. DAC systems increasingly use electricity, often sourced from renewables, to reduce lifecycle emissions. Deployment of smaller-scale units is accelerating as companies look to test, optimize, and scale. Policies are shifting from general incentives to more targeted mandates for carbon removal. Strategic alliances between DAC companies, energy providers, and financial institutions are becoming more common.

Market Key Players:

- Avnos, Inc.

- Capture6

- Carbon Capture Inc.

- Carbon Collect Limited

- Carbon Engineering ULC

- Carbyon

- Global Thermostat

- Heirloom Carbon Technologies

- Immaterial

- Infinitree LLC

- Mission Zero Technologies

- Mosaic Materials Inc.

- Noya PBC

- Octavia carbon

- RepAir Carbon

- Skytree

- Soletair Power

- Southern Green Gas Limited

- Spiritus

- Sustaera Inc.

- Climeworks AG

- Carbon Xtract Corporation

- Other Key Players

Conclusion: