Report Overview:

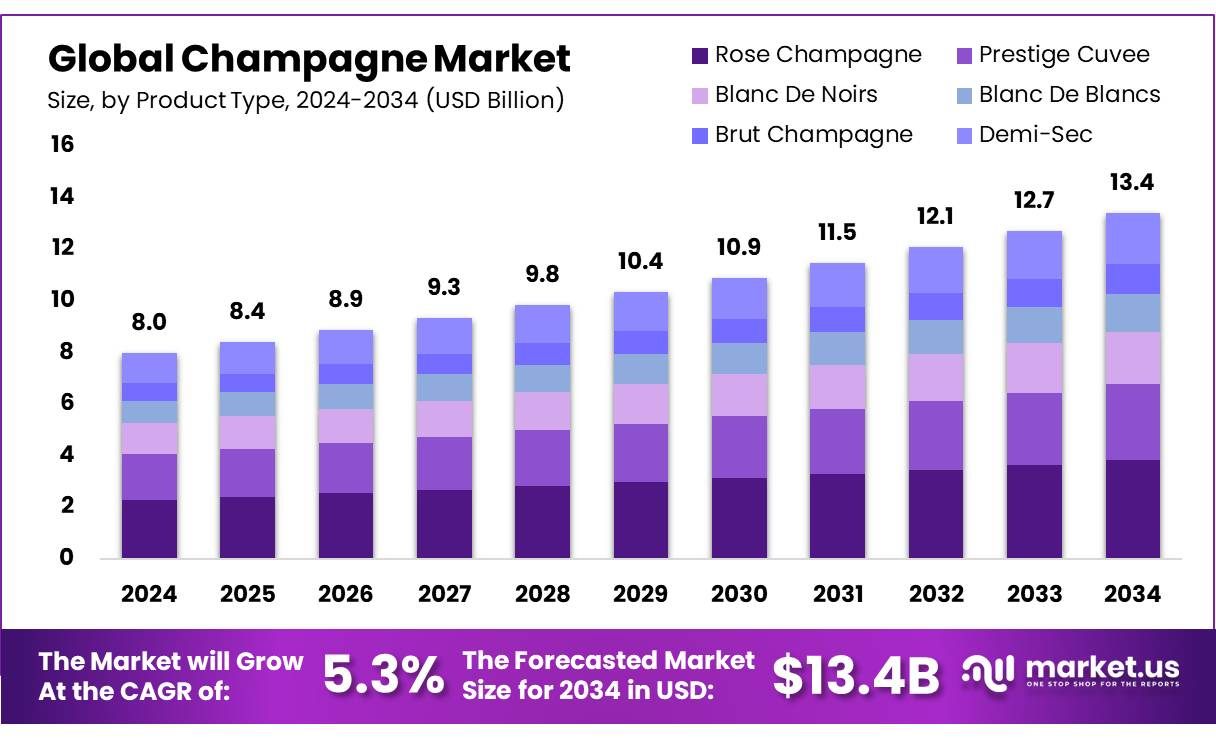

The global Champagne market, valued at about USD 8.0 billion in 2024, is projected to expand at a steadfast compound annual growth rate of 5.3%, reaching approximately USD 13.1 billion by 2034.

The growth reflects Champagne’s lasting appeal as a celebratory, premium beverage, crafted exclusively from Chardonnay, Pinot Noir, and Pinot Meunier grapes in France’s Champagne region. Known for its elegant bubbles and complex flavors notes of citrus, apple, toast, and almond it remains deeply associated with luxury. Its presence spans supermarkets, fine-dining establishments, and special occasions, reinforcing its market dominance in the sparkling wine category.

Consumer interest in high-end and novel Champagne experiences is rising, especially in emerging economies where disposable incomes and western influences are strong. Rosé Champagne is growing fastest among product types, driven by its visual appeal and trendiness, particularly among younger consumers; it captured about 29% of sales in 2024.

Key Takeaways:

- The global champagne market was valued at USD 8.0 billion in 2024.

- The global champagne market is projected to grow at a CAGR of 5.3 % and is estimated to reach USD 13.1 billion by 2034.

- Among product types, rose champagne accounted for the largest market share of 28.6%.

- Among grape varieties, Pinot Noir accounted for the majority of the market share at 46.5%.

- By capacity, 750 ML accounted for the largest market share of 67.4%.

- By distribution channel, on-trade accounted for the majority of the market share at 58.5%.

- Among producers, houses accounted for the largest market share of 74.5%

- North America is estimated as the largest market for champagne with a share of 39.4% of the market share.

![]()

Download Exclusive Sample Of This Premium Report:

https://market.us/report/champagne-market/free-sample/

Key Market Segments:

By Product Type

- Prestige Cuvee

- Blanc De Noirs

- Blanc De Blancs

- Rose Champagne

- Brut Champagne

- Demi-Sec

By Grape Variety

- Pinot Noir

- Pinot Meunier

- Chardonnay

- Others

By Capacity

- 200 Ml

- 375 Ml

- 750 ML

- 1500 Ml

- Above 1500Ml

By Distribution Channel

- On-trade

- Pubs, Bars & Cafe’s

- Hotels & Restaurants

- Others

- Off-trade

- Supermarkets/Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

By Producers

- Houses

- Growers

- Cooperatives

Drivers:

Champagne’s enduring charm stems from the worldwide embrace of wine culture as both a lifestyle symbol and a mark of sophistication. With rising affluence across the globe, especially in emerging economies, more consumers are indulging in premium alcoholic beverages. Champagne, long synonymous with celebrations and status, has carved a strong niche among both traditional and modern drinkers .

Simultaneously, there is a noticeable shift toward more mindful consumption. Today’s consumers often prefer low‑sugar, moderate‑alcohol options that still deliver a sense of sophistication here, Champagne fits the bill. The influence of Western dining culture, particularly among urban millennials and women, drives Champagne sales in upscale restaurants, bars, clubs, and blended food‑and‑drink experiences

Social media has further boosted its appeal, making visually appealing varieties like rosé Champagne especially popular.Regulatory protections also play a role. Champagne benefits from a strong PDO (Protected Designation of Origin) status, ensuring only wines made in Champagne using traditional methods can carry the name. This authenticity builds consumer trust and preserves Champagne’s premium reputation

As a result, demand is steadily rising fueled by a combination of cultural cachet, shifting lifestyle preferences, and legal safeguards firmly supporting Champagne’s position in the upscale beverage market.

Opportunities:

The rise in demand for organic and biodynamic Champagne offers an exciting avenue for differentiation and sustainable growth. As consumers grow more environmentally mindful, they are increasingly drawn to products that are healthier, cleaner, and ethically produced. Organic Champagne crafted without synthetic chemicals and biodynamic variants following holistic farming principles answer this growing demand for transparency and ecological responsibility.

In France alone, around 36% of wine drinkers regularly choose organic options; in the U.S., organic wine sales grow about 10% annually, signaling strong momentum.or producers, aligning with these trends allows leveraging sustainability certifications as a market advantage.

Regional policies encouraging reduced herbicide use and lower carbon emissions further create incentives to convert vineyards to eco‑friendly agriculture . Champagne’s collective initiatives like targets to reduce emissions by 20% per bottle underscore industry-wide movement toward greener practices .

Restraints:

While Champagne enjoys impressive momentum, certain headwinds must be acknowledged. Health and wellness trends have evolved into powerful forces, with anti‑alcohol movements gaining traction worldwide. Influential bodies like the World Health Organization now emphasize that “no amount of alcohol is entirely safe,” increasing awareness about potential risks even low-level intake can be frowned upon . Consequently, a growing segment of consumers especially younger, health‑focused demographics is reducing or avoiding alcohol consumption, which could dampen Champagne demand over time.

Regulatory frameworks add another layer of complexity and cost. Champagne adheres to strict standards, such as manual harvesting, minimum lees aging, and adherence to the Appellation d’Origine Contrôlée (AOC) rules. In the U.S., producers must comply with regulations like the FDA’s Food Safety Modernization Act, further increasing compliance costs.

Together, these trends health consciousness and heavy compliance burdens could slow market growth or shift it toward more moderate, organic, or alternative beverages. While Champagne’s prestige endures, its producers must adapt strategically to changing consumer attitudes and mounting regulatory pressures.

Trends:

Geopolitical trade disruptions pose a threat, particularly tariffs on European imports (e.g., U.S. tariffs introduced in 2023–2024). These impact pricing and demand in key markets, with European producers forced to navigate shifting trade conditions .

Despite its prestige, the Champagne market faces key restraints that could limit growth potential, especially in the long term. One of the primary challenges is the growing health-conscious mindset among consumers. Increasing awareness around the negative health effects of alcohol consumption amplified by global health organizations has led many to reduce or eliminate alcoholic beverages from their lifestyle.

Younger demographics, in particular, are shifting toward sober-curious movements or replacing alcohol with non-alcoholic alternatives. This behavioral shift could directly impact Champagne sales, especially in regions where wellness trends are deeply rooted. Moreover, stringent regulatory frameworks surrounding production and export further complicate growth. Champagne is bound by rigid geographical and production standards under the Protected Designation of Origin (PDO) rules, which, while ensuring authenticity, can also restrict innovation and expansion.

In countries like the U.S., compliance with food safety and labeling regulations adds another layer of operational complexity and cost. Smaller growers and new entrants often struggle to meet these requirements, limiting diversification in the market. These health and legal barriers, combined with a highly competitive premium beverage segment, act as constraints that producers must navigate carefully to sustain growth while staying compliant and relevant to modern consumers.

Market Key Players:

- Champagne Nicolas Feuillatte

- Laurent-Perrier

- Lanson-BCC

- LVMH

- Pernod Ricard

- Piper-Heidsieck

- Champagne Pommery

- Taittinger

- Thiénot Bordeaux-Champagnes

- Veuve Clicquot Ponsardin

- Cook’s California Champagne

- Korbel California Champagne

- Champagne Lanson

- Canard-Duchêne

- Moët Hennessy

- Other Key Players

Conclusion: