Report Overview:

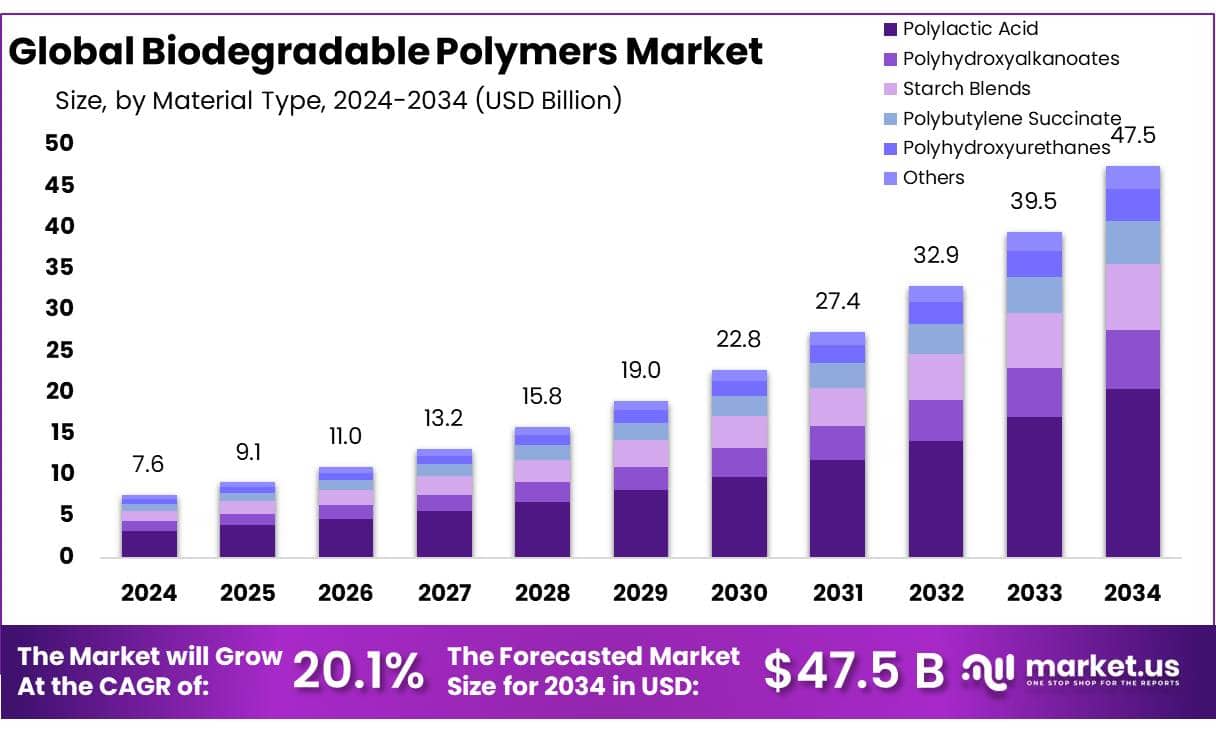

The global biodegradable polymers market is projected to grow significantly, reaching approximately USD 47.5 billion by 2034, up from USD 7.6 billion in 2024. This growth reflects a robust compound annual growth rate (CAGR) of 20.1% during the forecast period from 2025 to 2034.

Adoption is accelerating as environmental concerns intensify and regulations clamp down on single-use plastics. Consumers, brands, and governments alike are favoring materials that biodegrade in composting facilities or natural environments. This shift aligns with broader sustainability goals, reducing landfill waste and mitigating ocean pollution.

This shift is being driven by a growing awareness of environmental damage caused by plastics and by stricter regulations banning single-use plastics. Consumers, companies, and governments are all aligning toward greener materials. Biodegradable polymers, especially in packaging, agriculture, and healthcare, are becoming central to this eco-friendly transformation.

Key Takeaways:

- Biodegradable Polymers Market size is expected to be worth around USD 47.5 Billion by 2034, from USD 7.6 Billion in 2024, growing at a CAGR of 20.1%.

- Polylactic Acid (PLA) held a dominant market position, capturing more than a 43.1% share of the biodegradable polymers market.

- Packaging held a dominant market position, capturing more than a 56.6% share of the biodegradable polymers market.

- Asia-Pacific (APAC) region emerged as the dominant player in the biodegradable polymers market, capturing a significant share of 36.2%, valued at approximately USD 2.7 billion.

Download Exclusive Sample Of This Premium Report:

https://market.us/report/global-biodegradable-polymers-market/free-sample/

Key Market Segments:

By Material Type

- Polylactic Acid

- Polyhydroxyalkanoates

- Starch Blends

- Polybutylene Succinate

- Polyhydroxyurethanes

- Others

By Application

- Packaging

- Agriculture

- Medical

- Consumer Goods

- Textile

- Others

Drivers

The main engine behind this market’s growth is rising environmental awareness with global initiatives like plastic bag bans and landfill reduction targets and corporate commitments to reduce plastic waste. Stringent regulations, such as the EU’s Circular Economy Action Plan, are pushing businesses toward materials that are compostable or biodegradable by design.

Rising concern over plastic pollution is the main force behind the biodegradable polymers market. Nations worldwide are implementing bans on single-use plastics and setting sustainability targets. Simultaneously, consumers are increasingly choosing brands that use compostable packaging, while businesses incorporate these materials to enhance their green credentials.

Restraining Factors

Higher production costs Manufacturing biodegradable polymers typically costs 30–50% more than making conventional plastics. This stems from pricier feedstocks (like corn, sugarcane, or plant oils), specialized processing, and smaller-scale production setups.

Lack of processing infrastructure Especially in developing regions, there’s limited access to industrial composting or adequate recycling facilities. Without clear disposal pathways, even well-marketed biodegradable products may simply wind up in regular trash streams, hindering the environmental benefits.

Performance limitations Some biodegradable polymers fall short in strength, temperature resistance, or barrier properties important for packaging, medical devices, and industrial use. This can result in shorter product lifespans or the need for blends with conventional plastics adding complexity and cost.

Opportunities

There’s strong potential in sustainable packaging, with 56% of polymer demand coming from that sector. Growing markets like agricultural mulch films, compostable tableware, and medical implants offer new application fields. Technological innovation, such as coatings that biodegrade faster or microbes that enhance composting, can drive cost reductions and performance improvements.

The largest opportunity lies in sustainable packaging food containers, shopping bags, and shipping materials where brand reputation and consumer trust are vital. PLA’s market share and starch-based blends’ low-cost appeal underscore potential in flexible packaging and everyday products. Beyond packaging, biodegradable polymers are expanding into medical devices, agriculture films, biodegradable cutlery, and controlled-release offerings.

Trends

Biodegradable polymers are evolving rapidly, driven by demand for eco-friendly solutions and ongoing advances in material science. PLA holds the largest market share, especially in packaging, due to its compostability and ease of use. Starch-based blends are also becoming more popular, offering a cost-effective choice for agricultural films, disposable cutlery, and food containers especially when treated to improve strength and moisture resistance.

Starch based blends are also becoming more popular, offering a cost effective choice for agricultural films, disposable cutlery, and food containers especially when treated to improve strength and moisture resistance.

Technological breakthroughs are enhancing performance from nanotechnology improving barrier properties, to edible and water soluble packaging solutions, like rice paper and PVA films that dissolve in water and reduce waste.

Market Key Players:

- BASF

- Biome Technologies

- Borealis Group

- Changsu

- Corbion

- Danimer Scientific

- Evonik Industries AG

- FKUR

- Jiangmen Xinshuo New Materials Co., Ltd

- Kaneka

- Mitsubishi Chemical Group Corporation.

- NatureWorks LLC

- NaturTec

- Novamont S.p.A.

- Polysciences

- Polysciences Inc

- TotalEnergies

Conclusion

The biodegradable polymers market stands at an exciting tipping point. Its rapid growth mirrors a global shift toward more sustainable materials, supported by strong policy action and consumer preference. With PLA and starch-based polymers leading the charge, the market is expanding across multiple industries from packaging to agriculture and healthcare.

Nonetheless, rising costs and the need for reliable end-of-life infrastructure remain key barriers. To unlock full potential, companies and regulators must invest in cost-effective production, robust composting systems, and transparent labeling.

That said, cost challenges and infrastructure limitations need addressing for mainstream uptake. By investing in lower-cost production, building robust waste processing systems, and standardizing certifications, biodegradable polymers can truly shift from niche alternatives to everyday materials central to a circular economy.